Running a small business can be one of the most rewarding experiences in life, but it also comes with challenges that go far beyond managing employees or keeping customers happy. For many entrepreneurs, the financial side of the business is where things become complicated. Taxes, compliance, payroll, bookkeeping, and long-term strategy can feel overwhelming without expert help. That is where working with a small business CPA becomes not just an advantage but a necessity.

What Is a Small Business CPA?

A CPA, or Certified Public Accountant, is a professional working in finance who is licensed to provide auditing, accounting, and tax services. While all CPAs meet rigorous education and testing requirements, a small business CPA focuses specifically on the unique needs of small companies.

The Value of Professional Financial Guidance

Many entrepreneurs try to handle accounting tasks themselves or rely on basic bookkeeping software. While these tools are useful, they are not a replacement for professional guidance. A CPA brings insight and perspective that go beyond data entry. Here are a few reasons their expertise matters:

- Compliance with Tax Laws: Tax rules change frequently. A small business CPA stays up to date with federal, state, and local requirements so that your business avoids penalties.

- Credibility with Lenders: Financial institutions often trust reports prepared by CPAs more than those handled internally.

- Stress Reduction: Perhaps most importantly, having someone you can rely on for financial clarity allows you to focus on running and growing your business.

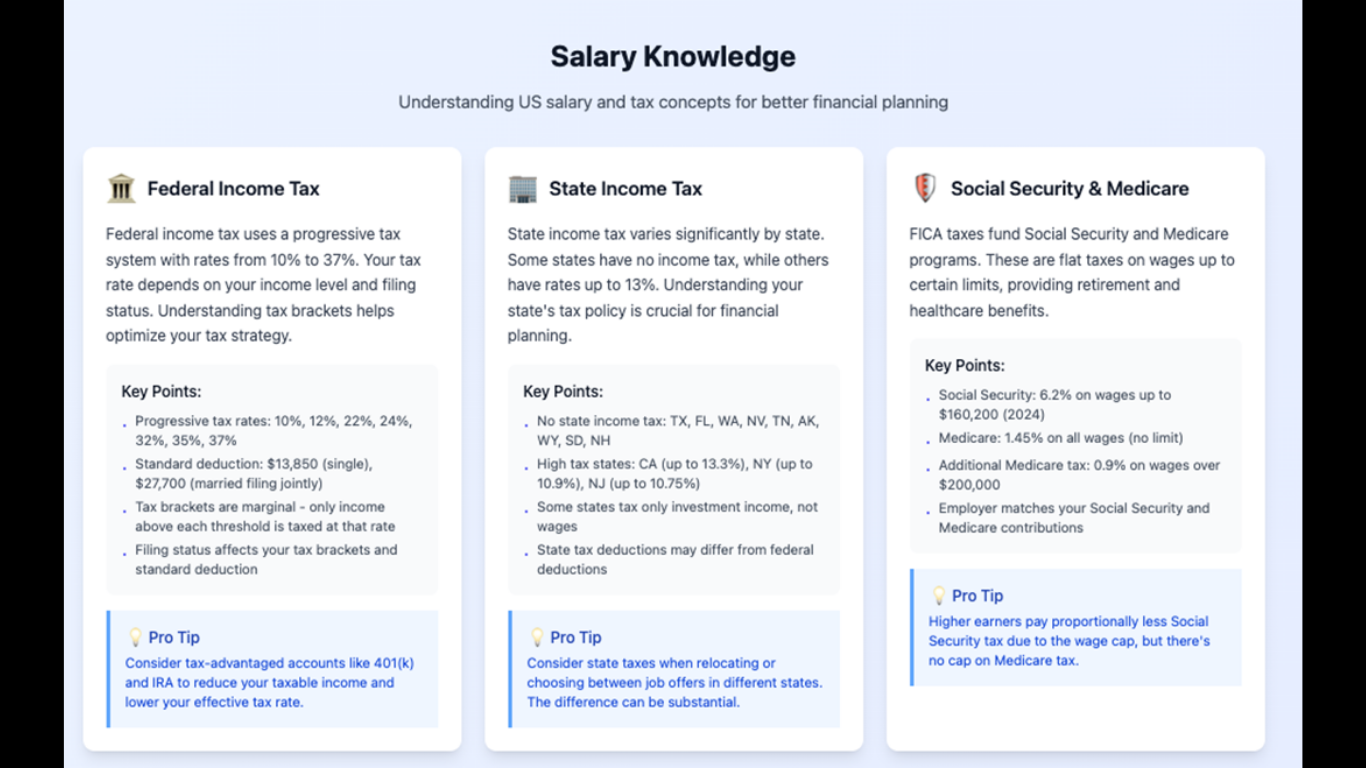

Tax Planning and Preparation

Small businesses often hire a CPA to help with tax planning and preparation. Filing taxes can be one of the most stressful aspects of running a business, especially when you are juggling multiple obligations. A small business CPA can:

- Identify deductions and credits that you may not realize apply to your business.

- Plan throughout the year to minimize your tax burden instead of scrambling at the last minute.

Managing Cash Flow Effectively

Cash flow is seen as the lifeblood of businesses regardless of size. Even profitable businesses can fail if they run into cash shortages. A CPA can help you understand the timing of your expenses and income, identify potential tight points, and implement solutions for all of your problems. For example, they may recommend adjusting your invoicing practices, negotiating better terms with vendors, or creating cash reserves.

Financial Forecasting and Budgeting

Planning for the future requires more than optimism. Financial budgeting and predicting are essential tools for guiding choice making. A CPA can use historical data to predict revenue trends, project expenses, and highlight areas where adjustments are needed.

Risk Management and Compliance

Every business faces challenges across the spectrum of unexpected expenses to legal changes. A CPA can act as a watchdog, identifying potential risks before they become serious problems. Whether it’s compliance with labor laws, proper record-keeping, or safeguarding against fraud, CPAs provide oversight that protects both the business and its owners.

Business Structure and Growth Planning

Choosing the right structure for your business—sole proprietorship, partnership, LLC, or corporation—can have major tax and liability implications. A small business CPA can guide owners through the pros and cons of each option, ensuring that the choice aligns with both short-term needs and long-term goals.

When Should You Hire a CPA?

Some business owners wait until tax season to hire professional help, but the best time to bring a CPA on board is much earlier. Here are a few indicators that it may be time to work with one:

- You are spending more time fretting about finance and its management than running your business.

- Your taxes have become increasingly complex.

- You are planning to hire employees or expand operations.

- You are considering applying for a loan or seeking investors.

How to Choose the Right Small Business CPA

Not all CPAs are the same, and choosing the right one is critical. Consider the following factors:

- Experience with Small Businesses: Make sure they have worked with companies similar to yours in size and industry.

- Communication Style: Look for someone who explains things clearly and is responsive to questions.

- Technology Use: A CPA who embraces modern tools can make collaboration much easier.

- Reputation and References: Ask for recommendations from other business owners and check credentials.

- Finding the right fit ensures that your CPA is not just a service provider but a trusted advisor.

Take Charge of Your Financial Future

Whether you are just starting out or looking to expand, the expertise of a CPA can help turn goals into reality. Instead of navigating the complex world of cash flow, taxes, and compliance by yourself, you’ll have a trusted partner to guide you through every step of the process.

Article received via email