Technological innovations are reshaping the insurance landscape, driving efficiency and precision. Data analytics and machine learning enhance underwriting and pricing, offering significant advancements. As the industry evolves, staying abreast of these changes is crucial for maintaining competitiveness.

The insurance industry is undergoing a significant transformation as new technologies emerge to streamline operations and improve services. Staying informed about these advancements is essential for both businesses and individuals navigating the complex world of insurance. In the health and life insurance sectors, integrating data analytics and machine learning is revolutionizing traditional practices, paving the way for more accurate risk assessments. By understanding these changes, you can better appreciate the future trajectory of insurance coverage.

The transformative role of technology in insurance

Technology’s influence on the insurance industry is profound, reshaping how companies assess risk and interact with clients. Data analytics plays a central role, providing insurers with insights that were previously inaccessible. By analyzing vast amounts of data, companies can predict trends and potential risks with greater accuracy. This predictive capability enables insurers to make informed decisions, enhancing their ability to offer competitive rates.

Machine learning further augments these capabilities by automating complex processes that once required manual intervention. Through algorithms that learn from historical data, insurers can refine their models over time, improving efficiency and reducing errors. This advancement not only streamlines operations but also enhances the overall accuracy of underwriting practices.

Predictive analytics serves as a cornerstone for these technological advancements, allowing insurers to foresee potential claims and adjust their strategies accordingly. By leveraging these tools, insurance companies can optimize their offerings and deliver more personalized coverage options to clients, ensuring they meet diverse needs effectively.

Revolutionizing underwriting processes for better pricing

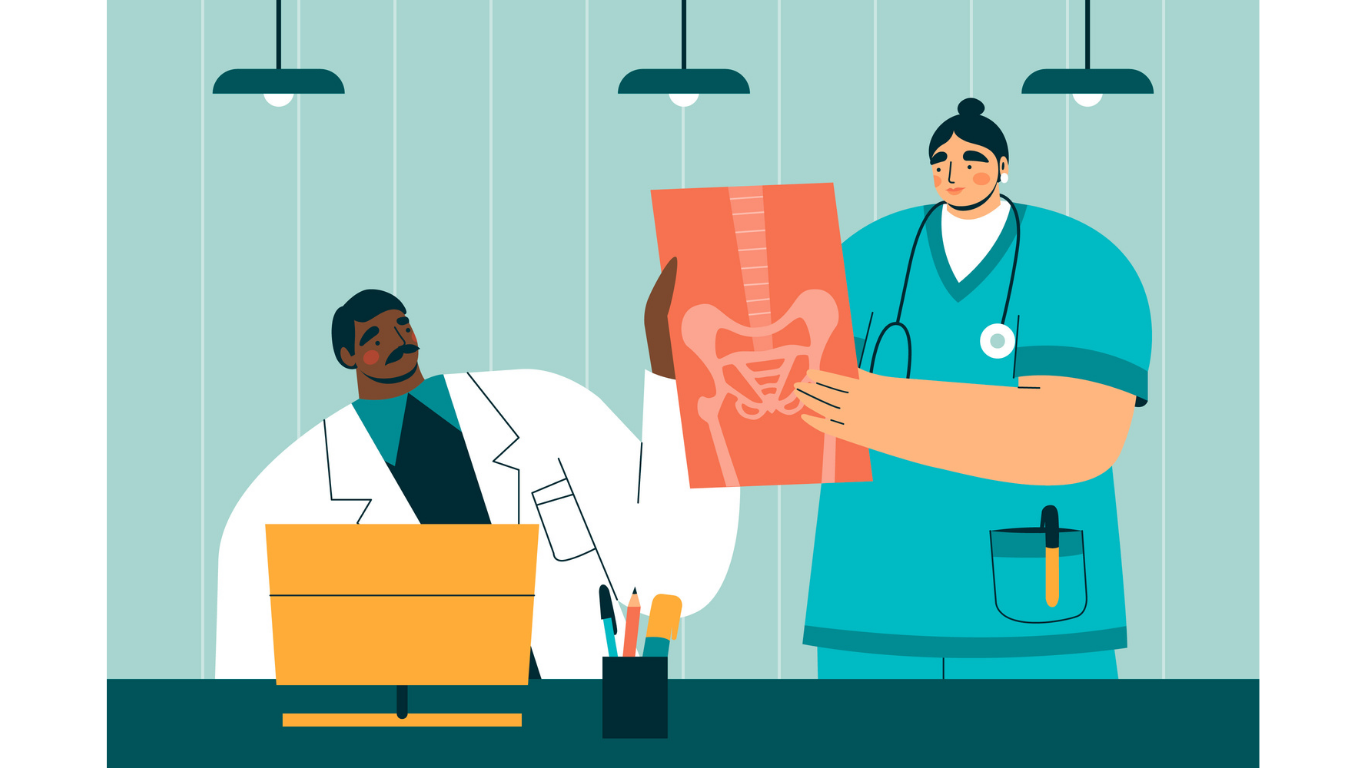

The integration of advanced technologies in underwriting has significantly altered how life insurance companies determine pricing strategies. Traditional methods relied heavily on static data points; however, modern tools offer dynamic insights that adapt to changing circumstances. This evolution leads to more accurate risk assessments, ensuring that policies reflect the true level of risk associated with each client.

Data analytics allows insurers to evaluate a broader range of factors when assessing applications. By incorporating lifestyle and health data, insurers gain a holistic view of an applicant’s risk profile. This comprehensive approach reduces uncertainty in pricing strategies, resulting in fairer premiums that accurately reflect individual risk levels.

Moreover, machine learning models continuously refine themselves by learning from new information as it becomes available. This adaptability ensures that underwriting remains relevant in an ever-changing environment, providing life insurance companies with the agility needed to respond to emerging trends swiftly. As a result, businesses can maintain liquidity while offering competitive products tailored to consumer needs.

Enhancing customer experience through technological innovations

Innovative technologies not only improve internal processes but also significantly enhance customer experiences within the insurance sector. Personalized services are now more attainable due to advanced data processing capabilities that tailor coverage options to individual preferences and requirements.

Automation plays a pivotal role in streamlining interactions between insurers and clients. Processes such as policy issuance and claims management have become more efficient through automated systems that reduce waiting times and eliminate unnecessary paperwork. This efficiency boosts customer satisfaction by providing faster resolutions to common issues.

Furthermore, digital platforms enable clients to access information and manage their policies conveniently from any location. These platforms empower consumers by giving them control over their coverage details while providing transparency in communication with insurers. Such enhancements foster trust and loyalty among policyholders, driving long-term relationships built on reliability.

Adapting to industry trends by integrating tech-driven solutions

To remain competitive in an evolving marketplace, it is imperative for a business within the insurance industry to adapt swiftly by integrating tech-driven solutions into their operations. Embracing innovation not only improves efficiency but also positions companies as leaders at the forefront of change.

The adoption of digital tools enables insurers to offer enhanced products like a life insurance policy with liquidity options designed specifically for modern consumers seeking flexibility within their coverage plans. These innovative offerings cater directly to emerging demands from clients who value adaptable solutions aligned with contemporary lifestyles.

Additionally, by leveraging technological advancements such as artificial intelligence (AI) alongside existing systems infrastructure seamlessly integrated into daily operations across departments, organizations gain valuable insights enabling strategic decision-making processes aimed at enhancing profitability and growth potential. This approach is essential in a competitive landscape where rapid technological disruptions affect entire industries worldwide.

Blog received on email