Human resources leaders are uniquely positioned to influence workforce development and organizational financial strategies, and personal wealth-building initiatives. As companies look for innovative ways to strengthen employee benefits and enhance financial literacy, fractional real estate investment has emerged as an intriguing option. This modern approach allows individuals and organizations to access real estate markets in a flexible, scalable way that was previously out of reach for many. For HR leaders, understanding this investment avenue can open doors to new financial wellness initiatives, talent retention strategies, and personal investment growth.

Understanding Fractional Ownership in Real Estate

Fractional real estate investment breaks traditional property ownership into smaller, more manageable segments. Instead of taking on the full financial responsibility of a property, investors buy shares that correspond to ownership stakes. This structure makes it possible for HR leaders and employees to invest in property with RealT or another fractional investment platform that simplifies transactions and property management. Platforms like these handle administrative tasks such as property maintenance, tenant management, and rent collection.

Investors receive a proportional share of rental income and potential property appreciation. This approach diversifies investment portfolios and provides a hands-off way to participate in real estate markets, making it ideal for busy professionals who may not have time to manage traditional properties.

Aligning Investments With Employee Financial Wellness Programs

HR leaders play a central role in shaping employee benefits and financial wellness strategies. Fractional real estate opportunities can complement existing programs by offering employees alternative ways to build wealth outside of traditional retirement accounts. By introducing employees to fractional investment options, organizations can help workers diversify their assets, build passive income streams, and strengthen long-term financial security.

Workshops, webinars, and partnerships with fractional investment platforms can give employees the tools they need to make informed decisions. Providing education on investment strategies enhances financial literacy, boosts engagement, and demonstrates that the company values employees’ financial well-being beyond standard compensation packages.

Diversifying Personal Portfolios Strategically

For HR leaders themselves, fractional real estate investments present a strategic way to diversify personal portfolios. Unlike stocks or bonds, real estate offers tangible value and historically stable returns. Fractional ownership enables investors to spread their investments across multiple properties in different markets, reducing risk while gaining exposure to various asset types.

This level of diversification would typically require substantial capital in traditional real estate investing. With fractional models, investors can start with smaller amounts, making it easier to test different markets or property types.

Enhancing Talent Attraction and Retention

Offering valuable benefits can set organizations apart. Integrating fractional real estate opportunities into employee benefits programs can enhance the appeal of a company’s compensation packages. Employees who feel supported in their financial growth are more likely to stay long term, reducing turnover costs and boosting morale.

Fractional investing programs can be positioned alongside other financial benefits like stock options or retirement contributions. By giving employees more ways to participate in wealth-building activities, HR leaders can foster a culture of financial empowerment that resonates with both current and prospective talent.

Addressing Risk and Regulatory Considerations

While fractional real estate investing offers many advantages, it’s important to acknowledge potential risks. Property markets can fluctuate, and returns are not guaranteed. HR leaders exploring this avenue should work with legal and financial experts to ensure compliance with regulations governing investment opportunities.

Transparency is crucial. Any fractional investment programs introduced to employees should include clear explanations of how the model works, potential risks, and realistic expectations for returns. By providing accurate information, organizations can protect themselves and their employees while promoting responsible investment practices.

Leveraging Technology for Simpler Investment Management

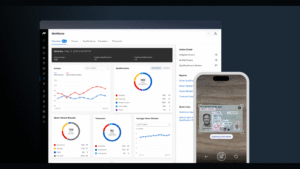

One of the biggest advantages of fractional real estate investing today is the use of technology to streamline transactions. Digital platforms manage everything from property selection to income distribution, making it easy for HR leaders and employees to participate without extensive administrative burdens.

These platforms offer dashboards where investors can monitor performance, view rental income distributions, and track appreciation in real time. This transparency and accessibility empower investors to make informed decisions and adjust their strategies as needed. For HR leaders, leveraging these tools can simplify implementation and create a seamless experience for employees interested in exploring new financial opportunities.

Fractional real estate investing provides HR leaders with a unique way to support employee financial wellness while exploring strategic investment opportunities for themselves. By understanding how fractional ownership works, aligning it with benefits programs, and using technology to simplify management, HR professionals can play a key role in democratizing access to real estate investing.

Blog received via Mail