The 2026 bridging market rewards brokers that combine speed with structural discipline. KIS Finance appears as the most versatile option due to its lender breadth and ability to handle complex and high-value cases, while International Property Finance Group suits expat and cross-border buyers, Landmark Private Finance fits high-net-worth portfolios, Propertyze works well for auction and refurbishment timelines, and Dev Brok aligns with development-led capital stacks. Selection works best once exit strategy, asset complexity, and urgency feel clear, otherwise rate comparisons miss the point. A steady hand beats a rushed one every time, and here’s the witty truth worth remembering: fast money feels slow when the paperwork drags its feet.

Short-term property finance continues to attract investors, developers, and buyers dealing with tight deadlines. Auction purchases, chain breaks, refurbishment schedules, and time-sensitive acquisitions all push demand toward specialist intermediaries. Choosing among the best bridging loan brokers in the UK shapes pricing, certainty of completion, and exit flexibility, which makes broker selection more than a tick-box exercise.

The brokers covered here reflect current market activity heading into 2026. Coverage stays practical and neutral, with one clear exception where stated. No sales gloss, no inflated claims, just what experienced borrowers actually weigh when comparing options.

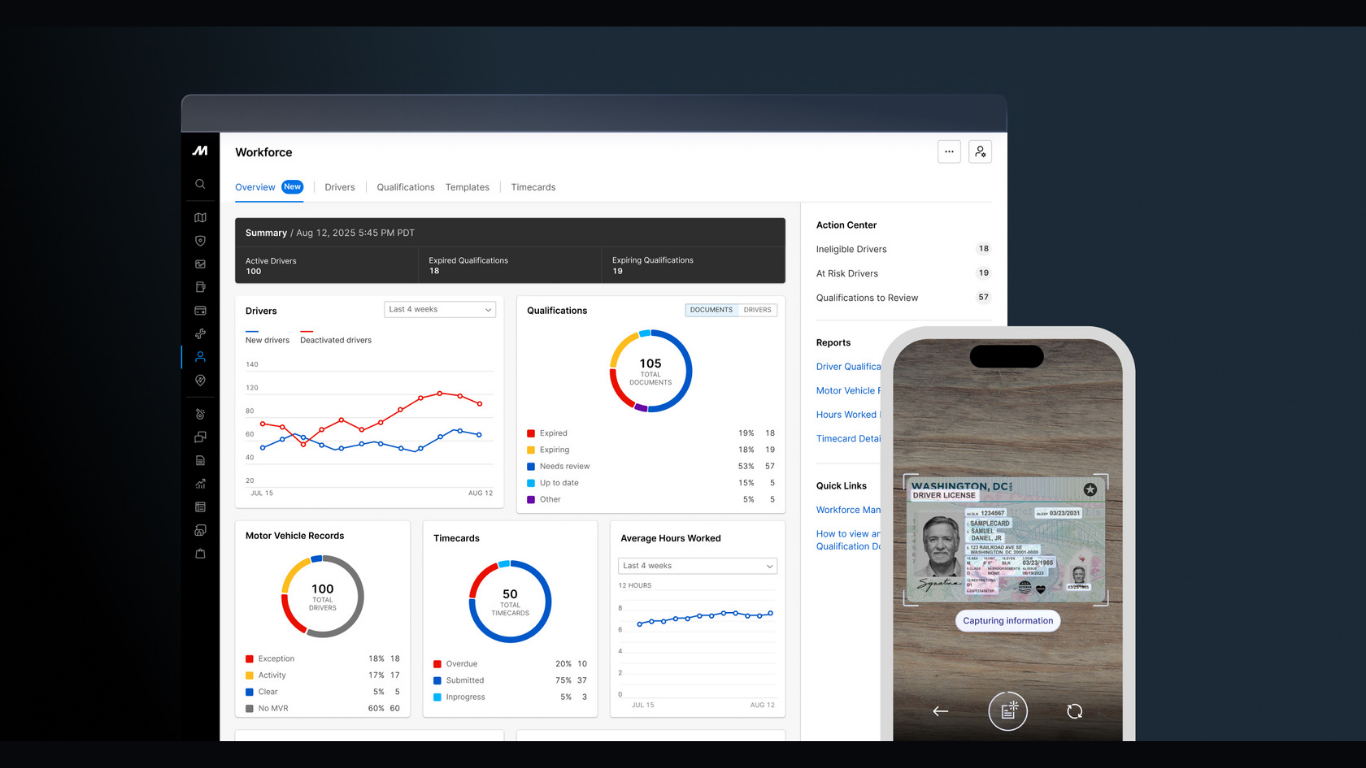

At-a-glance comparison

| Broker | Loan Amount | Loan Term | Best For |

| KIS Finance | £100k – £1bn | 1 day – 24 months | Complex cases |

| International Property Finance Group | Varies, up to large deals | Short-term | Expat/international investors |

| Landmark Private Finance | Varies for HNWIs | Flexible | High net worth portfolios |

| Propertyze | £90m+ facilitated | Short-term | Auctions/refurbishments |

| Dev Brok | Up to £250m GDV | Up to 24 months | Developers/equity needs |

The table highlights functional differences rather than crowning a universal winner. Horses for courses still applies, and that saying earns its keep here.

Market context heading into 2026

I believe the bridging market moving toward 2026 rewards intermediaries that combine lender breadth with disciplined exit logic. Pricing pressure persists, yet lenders continue to prioritise deals that show realism around valuation, timelines, and resale or refinance routes. Borrowers comparing the best bridging loan brokers in the UK often focus on headline rates first, while seasoned investors tend to look at execution certainty and risk containment.

Broker overviews

KIS Finance

KIS Finance stands out as the most versatile intermediary within this group. The firm arranges bridging finance across residential, commercial, and mixed-use assets, handling straightforward cases alongside highly structured transactions. A broad lender panel supports flexibility across leverage levels, security types, and timeframes.

Auction completions, chain breaks, and layered security scenarios sit squarely within its comfort zone. Decision timelines remain short, and adviser access stays direct rather than filtered. The firm also offers a bridging loan calculator that allows borrowers to model costs early, which helps frame discussions before underwriting begins.

Pros

- Rapid credit decisions and completions

- LTV flexibility extending to full security cases

- Loan sizes scaling from six to nine figures

Cons

- £100k minimum loan size

- Complex structures attract higher fees

Among the best bridging loan brokers in the UK, KIS Finance earns first position due to range, execution speed, and consistency across deal types.

International Property Finance Group

International Property Finance Group focuses on borrowers operating across borders, with particular strength supporting expats and foreign nationals. Team experience spans decades, translating into confidence handling overseas income streams, non-UK assets, and multi-jurisdictional ownership structures.

Bridging facilities often connect with longer-term funding strategies rather than sitting in isolation. That continuity suits investors who prefer a single advisory relationship rather than fragmented transactions. This profile places the firm firmly among the best bridging loan brokers in the UK for internationally active clients.

Pros

- Strong expertise with overseas buyers

- High repeat-client ratio

- Efficient process for time-constrained investors

Cons

- Narrower focus on standard UK residential cases

Landmark Private Finance

Landmark Private Finance concentrates on bespoke advisory work for high net worth individuals and complex portfolios. Relationships extend into private banks, specialist lenders, and alternative funding sources, which allows tailored structuring where standard products fall short.

Bridging loans here often support portfolio consolidation, refinancing gaps, or strategic acquisitions rather than speed-driven purchases. Canary Wharf roots and a relationship-led model suit borrowers who value discretion and structural nuance.

Pros

- Strong network across specialist and private lenders

- One-to-one advisory model

- Suitable for layered financial structures

Cons

- Less geared toward smaller transactions

Landmark Private Finance remains relevant among the best bridging loan brokers in the UK for sophisticated portfolios.

Propertyze

Propertyze connects investors and developers with a large network of specialist lenders. Reported funding volumes and asset counts indicate a model optimised for deal flow rather than occasional placements.

Common use cases include auction purchases, refurbishment funding, development transitions, and regulated bridging scenarios. Process efficiency and lender choice support fast comparisons during competitive bidding periods. Many repeat investors shortlist Propertyze when assessing the best bridging loan brokers in the UK for transaction speed.

Pros

- Wide specialist lender access

- Strong track record across funded assets

- Coverage across regulated and unregulated bridging

Cons

- Less emphasis on very small loans

Dev Brok

Dev Brok operates within development-led finance, covering senior debt, bridging, mezzanine layers, and equity participation. Team experience includes direct development exposure, which shapes realistic underwriting conversations.

Bridging finance acts as one element inside broader capital stacks rather than a standalone solution. That positioning suits developers working with GDV-driven schemes where structure matters more than raw turnaround time.

Pros

- Full-stack funding capability

- Access to equity and private capital

- Strong understanding of development risk

Cons

- Limited relevance for non-developer borrowers

How to choose the right broker

I think broker selection improves once borrowers define exit clarity, asset complexity, and acceptable leverage. Comparing the best bridging loan brokers in the UK works best when conversations move beyond rate cards toward lender behaviour, valuation management, and communication style. Early responsiveness often predicts how a deal behaves under pressure.

Final verdict

Each broker listed here addresses a different segment of the bridging market. KIS Finance leads due to breadth, speed, and consistency, while the others serve clearly defined borrower profiles. The strongest outcomes come from alignment between deal structure and advisory strength. In short-term finance, preparation usually beats panic, and a witty truth still applies: cheap money that arrives late rarely stays cheap.

Frequently asked questions

What does a bridging loan broker do?

A broker sources short-term property finance from suitable lenders, structures terms around security and exit plans, and manages the transaction through completion.

How long do bridging loans usually last?

Most facilities run from one month up to twenty-four months, depending on asset type, leverage, and exit strategy.

Can brokers help with complex or adverse cases?

Specialist brokers regularly arrange solutions for non-standard credit or ownership structures when security and repayment logic remain sound.

What costs apply beyond interest?

Borrowers should expect arrangement fees, valuation costs, legal fees, and broker charges, which vary with complexity and urgency.

How many brokers should a borrower speak with?

Two or three informed discussions usually provide enough contrast without slowing deal momentum.

Article received via email