Every corporate finance leader faces the same fundamental dilemma: You have limited capital and unlimited ways to spend it. Whether you are deciding between upgrading a factory, launching a new product line, or acquiring a competitor, the goal is always to maximize value.

But how do you measure that value?

For decades, two metrics have dominated the boardroom discussions regarding capital budgeting: Net Present Value (NPV) and the Internal Rate of Return (IRR). While they often lead to the same conclusion, they can sometimes give conflicting advice. When they disagree, knowing which one to trust determines whether you add real value to your shareholders or just spin your wheels.

The Intuitive Appeal of IRR

The Internal Rate of Return (IRR) is often the favorite among non-financial executives and business managers. The reason is simple: humans understand percentages.

If you tell a board member that Project A returns 15% and Project B returns 10%, they immediately know that Project A is “better” in terms of efficiency. IRR tells you exactly how hard your money is working. It represents the annualized effective compounded return rate that makes the net present value of all cash flows from a particular project equal to zero.

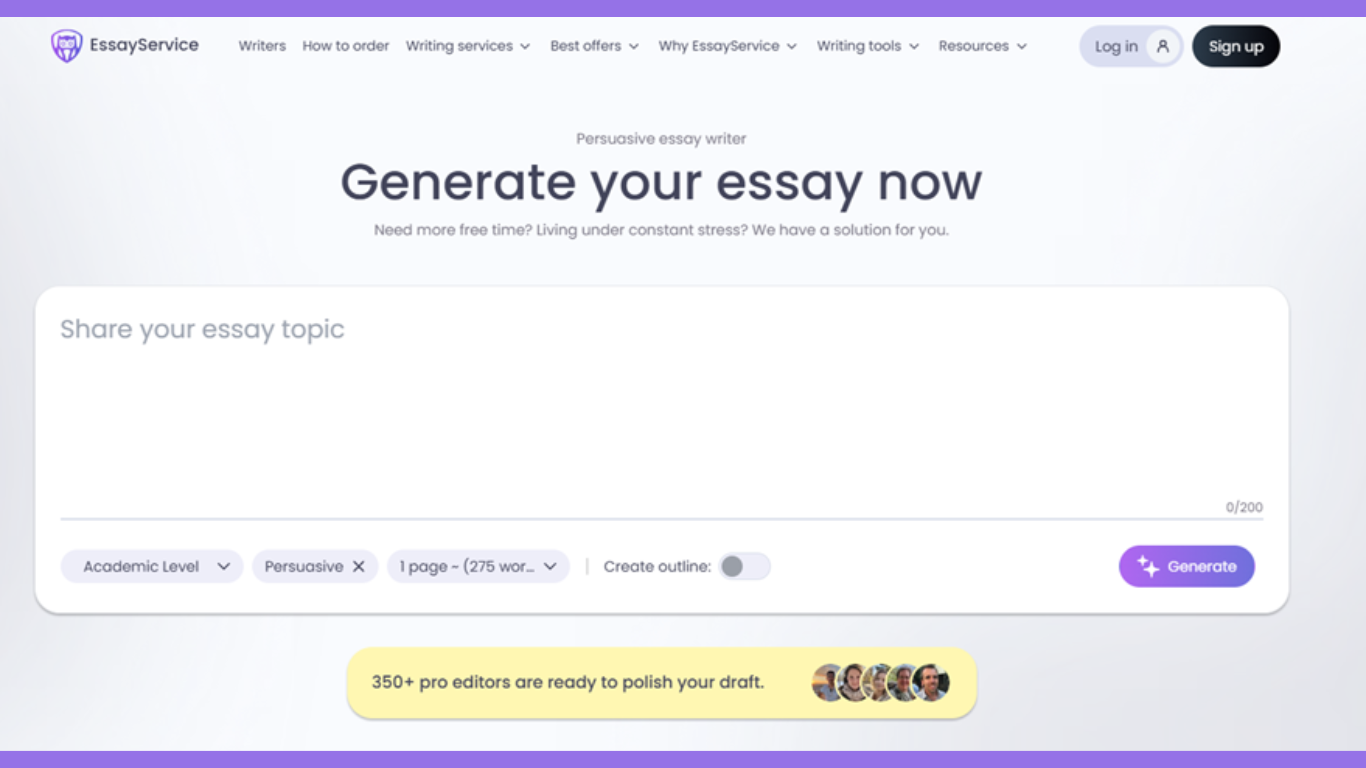

Because the math involves solving for a variable in an exponent, it isn’t something you can easily scribble on a napkin during a meeting. While spreadsheets can handle the heavy lifting, using a dedicated IRR calculator is the most efficient way to quickly stress-test different scenarios and see how changes in cash flow timing affect your percentage return.

This metric is fantastic for communicating with stakeholders. It provides a clear “hurdle rate”. If your company’s cost of capital is 8% and the project’s IRR is 14%, it’s an easy green light.

The Value Creation of NPV

While IRR measures efficiency, Net Present Value (NPV) measures wealth.

NPV calculates the total dollar value a project will produce, discounted back to today’s dollars. It answers a different question: “If we approve this project, how much richer will the company be today?”. Unlike IRR, which gives you a ratio, NPV gives you an absolute dollar amount. This is crucial because you cannot spend percentages. You can only spend dollars. In the eyes of pure academic finance, NPV is generally considered the superior metric because it aligns directly with the goal of maximizing shareholder wealth.

In practice, comparing projects often comes down to modeling future cash flows and discount rates, which is why many teams use a net present value calculator to translate long-term assumptions into a single, decision-ready number.

Summary

So, which metric should guide your allocation? The answer is not to pick one, but to use them in the correct order.

Smart financial managers use IRR as a screening tool. It ensures a project meets the minimum threshold of efficiency required to justify the risk. It answers, “Is this project good enough?” However, when choosing between two or more acceptable projects, NPV should be the deciding factor. It answers, “Which project adds the most value?”

By understanding the strengths of IRR for communication and the power of NPV for valuation, you can build a capital strategy that is both efficient and wealth-maximizing. Don’t let the simplicity of a percentage distract you from the ultimate goal of absolute value creation.

Article received via email