In today’s borderless talent market, senior professionals and corporate leaders are increasingly presented with opportunities that span continents. A CTO in Singapore is headhunted for a role in Silicon Valley. A managing director in Frankfurt is offered a position to lead a division in London. The compensation packages are substantial, designed to attract top-tier global talent.

However, for the astute business leader, the headline gross salary is merely the opening line of a complex financial equation. The true value of an international offer the net disposable income that will fund an executive’s lifestyle, investments, and family needs is hidden behind a veil of national tax regimes, social security structures, and regional deductions. For corporations and professionals alike, miscalculating this net figure can lead to failed relocations, unexpected financial strain, and eroded trust. In global business, compensation clarity isn’t a personal finance matter; it’s a strategic imperative.

Deploying the Best Due Diligence Tool for International Hires

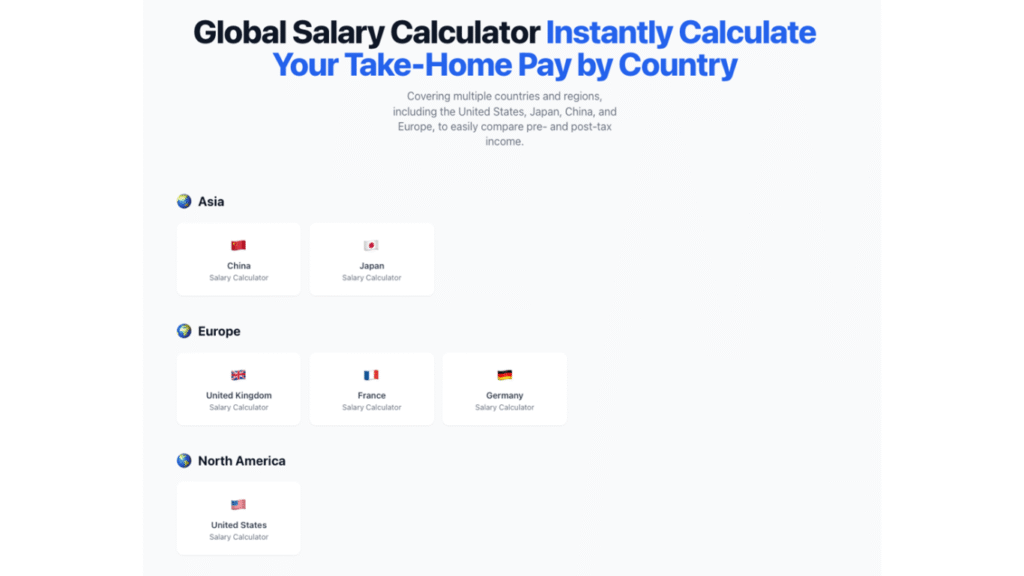

Before a company finalizes an offer letter or a candidate signs a contract, a critical risk assessment must occur: a precise translation of the compensation package into localized net income. Relying on rough estimates or generic “expatriate tax rates” is a significant governance oversight. The fiscal difference between assigning an executive to Zurich versus Berlin, or to Texas versus New York, can amount to tens of thousands in annual disposable income, fundamentally altering the attractiveness of the role.

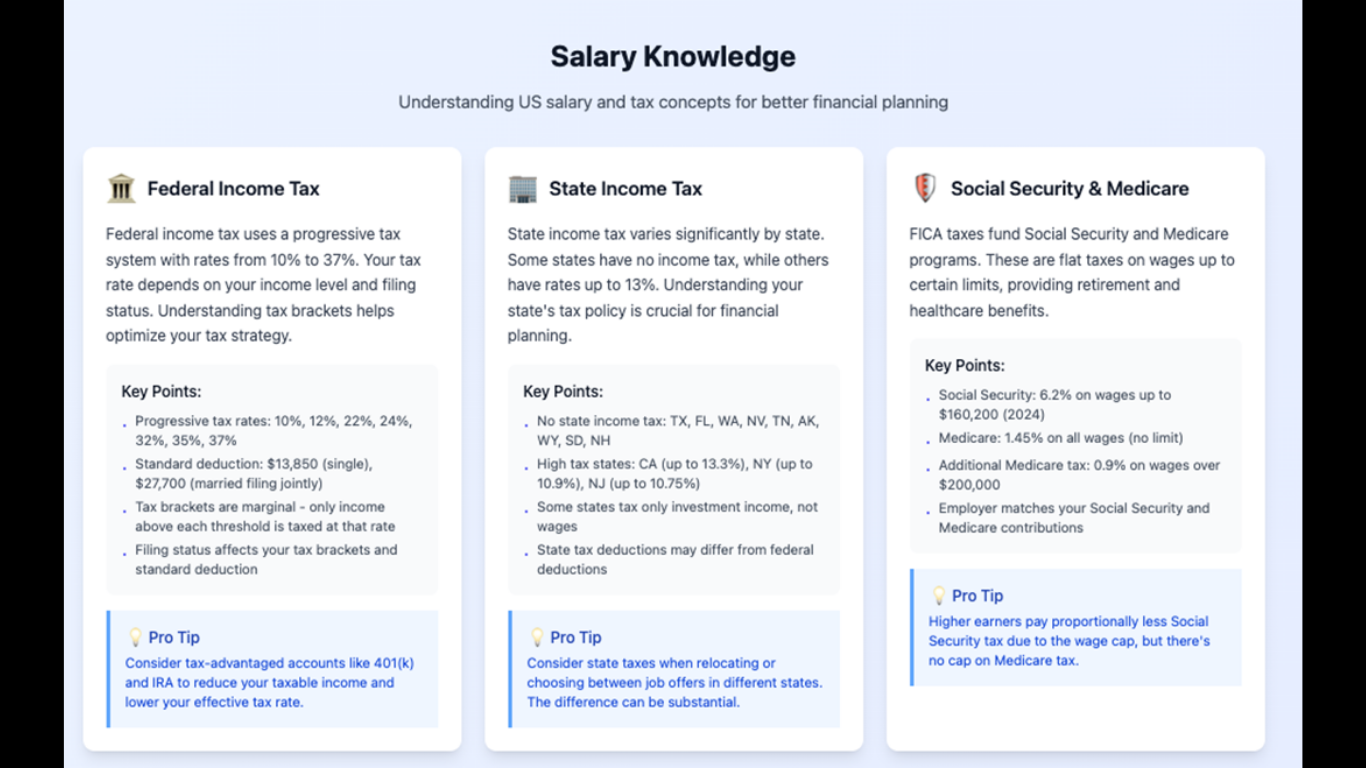

This is where a sophisticated global salary calculator transitions from a simple utility to an essential piece of strategic planning software. It acts as a financial modeling engine, processing the gross compensation through the specific, current algorithms of the destination country’s tax authority. For a firm bringing a European executive to the United States, utilizing a precise net salary calculator USA is non-negotiable. It provides a clear forecast of federal, state (e.g., California’s 13.3% top rate vs. Florida’s 0%), and FICA deductions, offering both employer and candidate a transparent, data-driven view of the offer’s real value.

Securing the Best Outcomes in Negotiation and Relocation

For business leaders and the HR departments that support them, this net-income clarity is the cornerstone of successful international placements. It enables:

- Structuring the Most Competitive and Transparent Offers. Global talent expects sophistication. Presenting a candidate with a clear net-income projection alongside the gross salary demonstrates rigorous planning and respect for their financial foresight. It builds trust from the outset and positions the company as a detail-oriented, reliable partner.

- Conducting the Most Informed Cost-Benefit Analysis for Global Mobility. Is the premium of a London-based package justified compared to a role in Amsterdam or Dublin after accounting for the UK’s income tax and National Insurance? For an executive, which offer provides greater long-term wealth accumulation potential? Dedicated calculators for key economies allow for apples-to-apples comparisons, turning subjective choice into objective strategy.

Mitigating the Top Financial Risks in Executive Relocation. Unexpected tax liabilities are a primary cause of relocation failure. A robust salary calculator helps identify potential issues like “tax equalization” complexities, bonus taxation, and the net value of benefits-in-kind. This allows for proactive package structuring such as gross-up calculations or tailored allowances to ensure the executive’s financial expectations are met precisely.

The Best Defence Against Compensation Misalignment

A prevalent concern that can derail negotiations is the executive’s fear of “tax bracket creep” in high-tax jurisdictions. A professional-grade calculator provides an authoritative, line-item breakdown that debunks this myth, clearly illustrating the progressive nature of taxation and proving that a higher gross compensation always results in superior net earnings. It replaces speculative anxiety with contractual certainty.

For world-class businesses and the leaders they recruit, ambiguity in compensation is an operational risk. In the high-stakes arena of global talent acquisition, the ability to precisely model and communicate net financial value is a competitive advantage. It signals professionalism, ensures alignment, and lays the financial groundwork for a successful, long-term partnership. Before your next cross-border hire or career move, mandate clarity. The most strategic decision is to eliminate guesswork and base multi-year commitments on exact, calculated net worth.

Article received on email