Choosing to manage a legal matter without professional help is a choice many people consider after a minor fender bender. It seems like a logical way to keep more of the settlement money while avoiding the perceived hassle of hiring a local firm.

The initial shock of the crash wears off and is replaced by a desire to get things back to normal quickly. Most drivers assume that a simple exchange of information and a few phone calls will resolve the problem within a few days or weeks.

The process often turns out to be more demanding than it appears on the surface. Successfully handling a car accident claim yourself requires organization and a firm grasp of how insurance companies evaluate property damage and physical injuries during the complex recovery phase.

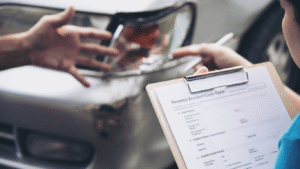

Initial Claim Filing Process

The first step involves notifying your own insurance carrier and the other driver’s company about the event. This sets the stage for the investigation and triggers the assignment of an adjuster who will oversee the details of the file from the very beginning.

You will need to provide basic facts like the date, time, and location of the incident. It is helpful to have the police report number ready so that the adjuster can access the official version of what happened according to the responding officers at the scene.

This phase requires a neutral and factual approach to avoid any confusion or misinterpretation of the events. Providing clear and concise answers helps the insurance companies open the claim correctly and prevents unnecessary delays in the very early stages of the medical evaluation process.

Negotiation With Insurers

Once the initial investigation is complete, the insurance company will likely present a settlement offer. This number is usually based on their internal formulas and the data gathered by the adjuster. It often represents a starting point rather than the final and absolute value.

You have the right to push back if the offer seems too low to cover your repairs and medical bills. This involves explaining why the current amount is insufficient and providing evidence to support a higher figure. It is a conversation that requires patience and persistence.

Stay calm and professional during these talks to ensure that the adjuster takes your concerns seriously. Being firm about your needs while remaining polite helps keep the lines of communication open. This ensures the negotiation moves forward without getting stuck in a cycle of denials.

Documentation and Deadlines

Success in a solo claim depends heavily on your ability to keep track of every single piece of paper. This includes medical bills, repair estimates, and receipts for any out of pocket expenses related to the crash. Organizing these items makes the process much easier.

Maintaining a detailed log of all conversations with the insurance company is also a smart move. Note the date, the time, and the name of the person you spoke with, along with a brief summary of what was discussed. This record prevents any confusion.

Deadlines are the most critical part of the administrative burden you must carry alone. Every state has specific time limits for filing claims. Missing these dates can result in losing your right to any compensation, so keeping a close eye on the calendar is essential.

Common Pitfalls

One of the biggest mistakes people make is accepting the very first offer from the insurance carrier. This initial amount is often lower than what is actually needed for a full recovery. Many victims realize too late that the money does not cover long term needs.

Giving a recorded statement without thinking about the consequences is another frequent error. Adjusters are trained to ask questions that might lead you to admit fault. These statements are difficult to take back once they are part of the official legal record of events.

Failing to document the full extent of physical pain can also hurt the value of a claim. It is important to see a doctor immediately and follow their advice completely. Gaps in treatment provide the insurance company with a reason to argue that the injuries are minor.

Conclusion

Managing your own claim is a significant undertaking that requires a lot of time and attention to detail. It is a path that works well for some, but it involves a level of risk that should be carefully considered before you start the process.

The goal is to reach a resolution that is fair and allows you to move on with your life. Staying organized and informed throughout the process provides the best chance of a successful outcome. It is a journey that tests your patience and advocacy skills.

While the process is technical, it is also a way to take control of your own recovery. By following the rules and staying focused on the facts, you can navigate the system effectively. Realizing the trade-offs involved helps you make the best choice.

Article received via email