Today’s markets are volatile, and companies face uncertainty amid shifting economic conditions and intensifying competition. Decisions made only at the business unit or project level are no longer enough. Leaders need to review their entire portfolio to understand trade-offs, manage risk, and ensure investments support long-term goals.

Making decisions at the portfolio level helps organizations set priorities, use resources efficiently, and remain flexible as circumstances change. Below, we’ll look at why these decisions matter more than ever and how data-driven tools can help leaders make better choices in portfolio management.

What Portfolio-Level Decision-Making Entails

Portfolio-level decision-making means considering all of an organization’s initiatives to ensure resources, risks, and results are optimized across the entire portfolio. This broad approach helps leaders make informed choices that support long-term strategy, rather than focusing only on individual projects.

Aligning Investments With Strategic Goals

A key part of portfolio-level decisions is ensuring each initiative supports the company’s core goals. By setting clear priorities, companies can determine which projects deliver the most value and support their major objectives. This ensures that time, money, and talent are used where they have the greatest impact.

Evaluating Trade-offs Across Projects

Not all projects can be treated the same, especially in uncertain markets. Portfolio analysis involves balancing trade-offs among risk, expected return, and required resources. Leaders must decide which initiatives to slow, accelerate, or discontinue. Tools that provide centralized data and analytics make these decisions more precise.

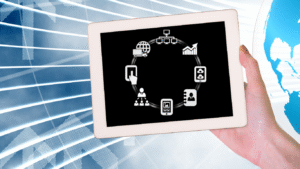

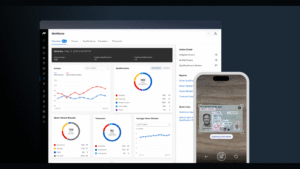

To support these decisions, organizations increasingly rely on a strategic portfolio management platform, which helps teams visualize trade-offs, align initiatives with strategic goals, and monitor portfolio performance in real time.

Frameworks for Effective Portfolio Management

Effective portfolio-level decision-making relies on systematic frameworks that help organizations evaluate, prioritize, and adjust initiatives in a disciplined way. These frameworks provide clarity in uncertain markets and ensure resources are allocated to projects with the greatest strategic impact.

Prioritization and Scoring Models

Scoring models let organizations rank projects by strategic value, expected return, and risk profile. By assigning measurable metrics to each initiative, decision-makers can objectively compare options and make investment choices that closely align with the organization’s goals.

Scenario Planning and Stress Testing

Scenario planning helps organizations anticipate different market outcomes and how these might affect the portfolio. Stress testing across various economic or competitive scenarios helps leaders identify weaknesses, develop contingency plans, and make proactive adjustments.

Continuous Monitoring and Rebalancing

Portfolios are dynamic and can change quickly. Regular reviews help ensure the portfolio aligns with the strategy, while rebalancing lets organizations shift funds, adjust priorities, and maximize results using real-time data. This agile approach builds resilience and helps organizations respond to uncertainty.

Benefits of Portfolio-Level Decision-Making

Portfolio-level decision-making offers clear benefits in unpredictable markets, helping organizations maximize impact and reduce risk.

Improved Resource Allocation

When leaders view all initiatives together, they can make the most of time, money, and talent, ensuring the most urgent projects receive the attention and resources they need.

Risk Mitigation Across the Portfolio

A holistic view allows organizations to diversify resources and exposure, helping to reduce the impact of market volatility or unexpected disruptions on overall results.

Greater Strategic Agility

With a portfolio-level view, organizations can respond quickly to change, make informed trade-offs, and adjust priorities to stay aligned with strategic goals.

Conclusion

Navigating uncertain markets requires a portfolio-based approach. Organizations can improve results and stay agile by focusing on initiative priorities, managing risk, and aligning resources with strategic goals. Using structured processes and technology helps make data-driven, timely, and effective decisions across the entire portfolio.

Article received via email