Due diligence within the M&A landscape depends on secure data management of sensitive business documents. Virtual data rooms offer safe online systems that allow users to securely share documents while working together in real time and having complete oversight of all the activities.

Market analysis shows that the virtual data room market reached a value of USD 2.42 billion in 2024. With a projected compound annual growth rate (CAGR) of 22.2%, it is expected to grow to USD 7.73 billion by 2030. Secure data management solutions for M&A transactions have experienced expanding demand, which drives the market value growth.

For this reason, this article explores the leading VDR providers for M&A and due diligence operations in 2025, examining their essential features and benefits.

What is a virtual data room (VDR)?

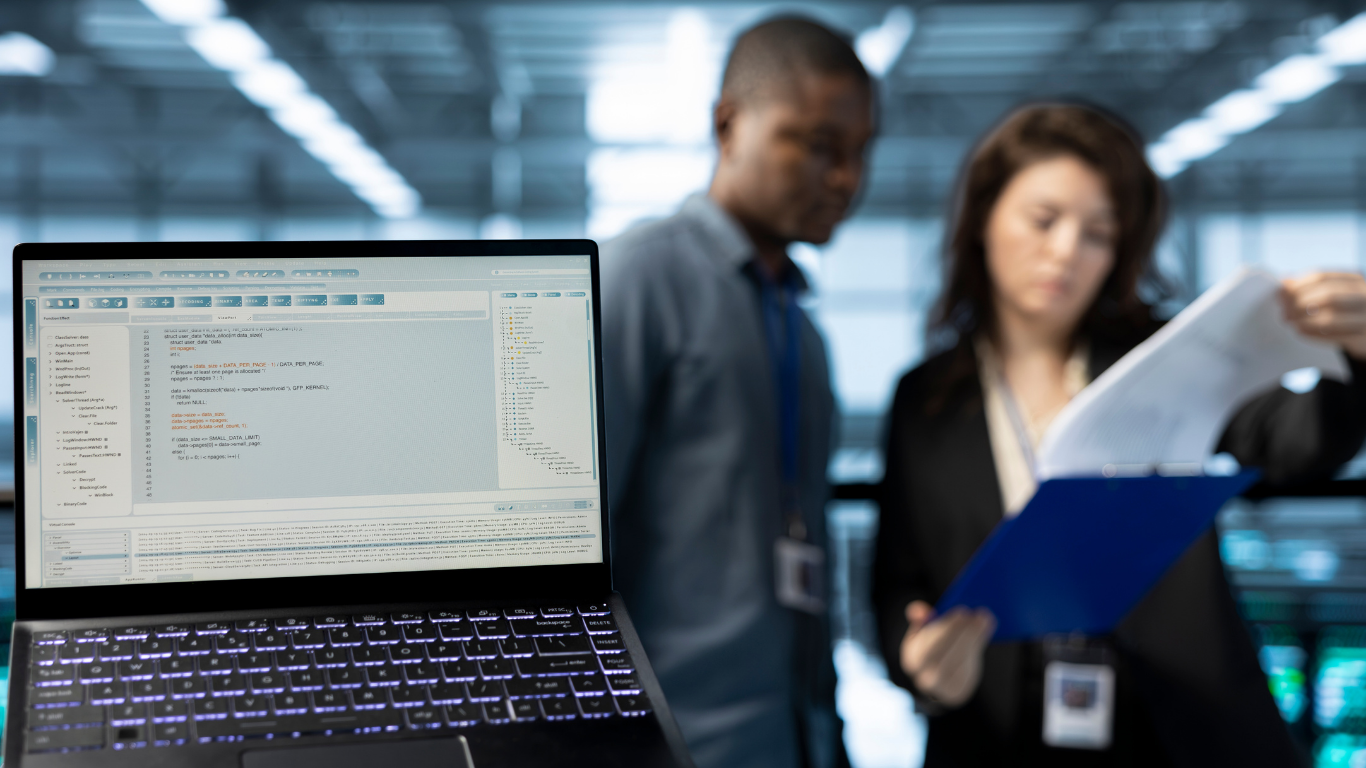

The virtual data room (VDR) runs through an online platform dedicated to secure document sharing and storage of confidential materials. VDR systems differ from routine file-sharing platforms because they provide encrypted document transfers with controlled access permissions and full documentation of user activities. Financial institutions, real estate, and legal companies use VDRs as essential security tools.

Key features to look for in virtual data rooms

Selecting a virtual data room requires a set of features to ensure secure operations, efficiency, and compliance throughout the transaction process. So, let’s break down how to compare the best virtual data rooms step by step.

1. Security measures

Business organizations choose virtual data rooms for their robust security measures. Dataroom service providers offer features such as encryption, two-factor authentication, and access rights management systems for sensitive information. The capabilities enable businesses to restrict document access to authorized users, thereby reducing the risk of data breaches.

2. Ease of use

The proper interface design of a VDR enables smooth navigation for technology experts alongside users who lack technical experience. A quality data room system should offer straightforward document management functions, including drag-and-drop uploading, bulk upload, and search capabilities. Data rooms with these functionalities help users conduct their reviews more efficiently, resulting in a better overall experience.

3. Collaboration tools

The fundamental requirement during due diligence is a seamless collaboration system. The features of a due diligence virtual data room must enable users to communicate in real-time. Faster deal decisions are facilitated by integrated Q&A sections, instant messaging, and document annotation capabilities, accelerating interactions between deal participants.

4. Audit trails

Auditors can view complete track records that display document access details and timestamps. A key requirement of M&A transaction security is full document transparency, which supports compliance efforts and verification procedures. The ability to record all document action positions VDRs as advanced security tools that aid business monitoring through transaction tracking and protection against unauthorized activities.

Best VDR providers for M&A and due diligence 2025

When selecting a VDR provider, it becomes essential to guarantee security and efficiency for M&A transactions. These are the premier data room providers suitable for M&A and due diligence work in 2025:

Ideals VDR

Multiple data room reviews indicate strong positive marks for ideals because of its accessible user interface, complete system capabilities, and dependable support organization.

Ideals VDR stands out as one of the leading virtual data room vendors by combining advanced security features with an intuitive, user-friendly interface. Trusted by businesses worldwide, Ideals supports secure collaboration in M&A transactions by ensuring full compliance with global security standards.

Additionally, virtual data room pricing is flexible, catering to businesses of all sizes. Whether you’re handling a small acquisition or a large-scale merger, Ideals can scale to meet your needs.

Intralinks

The VDR market solutions provided by Intralinks focus on large-scale M&A transactions while delivering established capabilities in this field. Intralinks implements AI-enhanced solutions that include automated workflow systems and redaction features to enhance document administration. From a security viewpoint and regulatory compliance aspects, Intralinks stands out as a top selection for banking and healthcare sectors.

Companies seeking a data room that integrates with their present business systems will find Intralinks an appealing choice because it easily connects to existing enterprise solutions.

Datasite

Due to its commitment to M&A due diligence services and document management, Datasite delivers a rich collection of tools specifically designed for due diligence. The platform stands out due to its AI analytics capabilities, which allow users to handle large data volumes and keep tabs on transaction developments. Datasite supports numerous languages, which helps companies operating internationally and conducting cross-border M&A activities.

Businesses can monitor deal advancement and locate operational issues because the interface of Datasite functions smoothly with detailed reporting functions.

Why choose a virtual data room for M&A?

A data room brings extensive advantages when used for M&A transaction management. The due diligence process becomes faster and more secure with Virtual Data Rooms because they enable parties to access documents at once and securely. The document management process becomes shorter through this system, which allows teams to make faster decisions.

Virtual data rooms protect sensitive information through their security measures, which lowers the chance of data breaches. The security features within VDRs include detailed audit trails and granular access controls, which ensure that companies fulfill their regulatory standards.

Conclusion

Dealing with increasing complexity in M&A transactions and due diligence requires secure, efficient data management solutions. Agencies performing crucial business transactions need virtual data rooms to be their essential operating tools. A suitable virtual data room enhances both the security of documents and their sharing and enables better project collaboration during M&A activities.

As businesses prepare for 2025, they should consider the five leading data room providers, which include Ideals VDR, Intralinks, Datasite, Firmex, and DealRoom, and their specific features for M&A professionals. Ultimately, selecting a virtual data room requires evaluating elements that include security protocols alongside ease of use and available collaboration tools, and audit trail functionality.

Companies can select due diligence data room providers that meet their precise requirements through effective assessment of the available options to guarantee secure M&A transactions in 2025 and beyond.

Blog as received in the mail