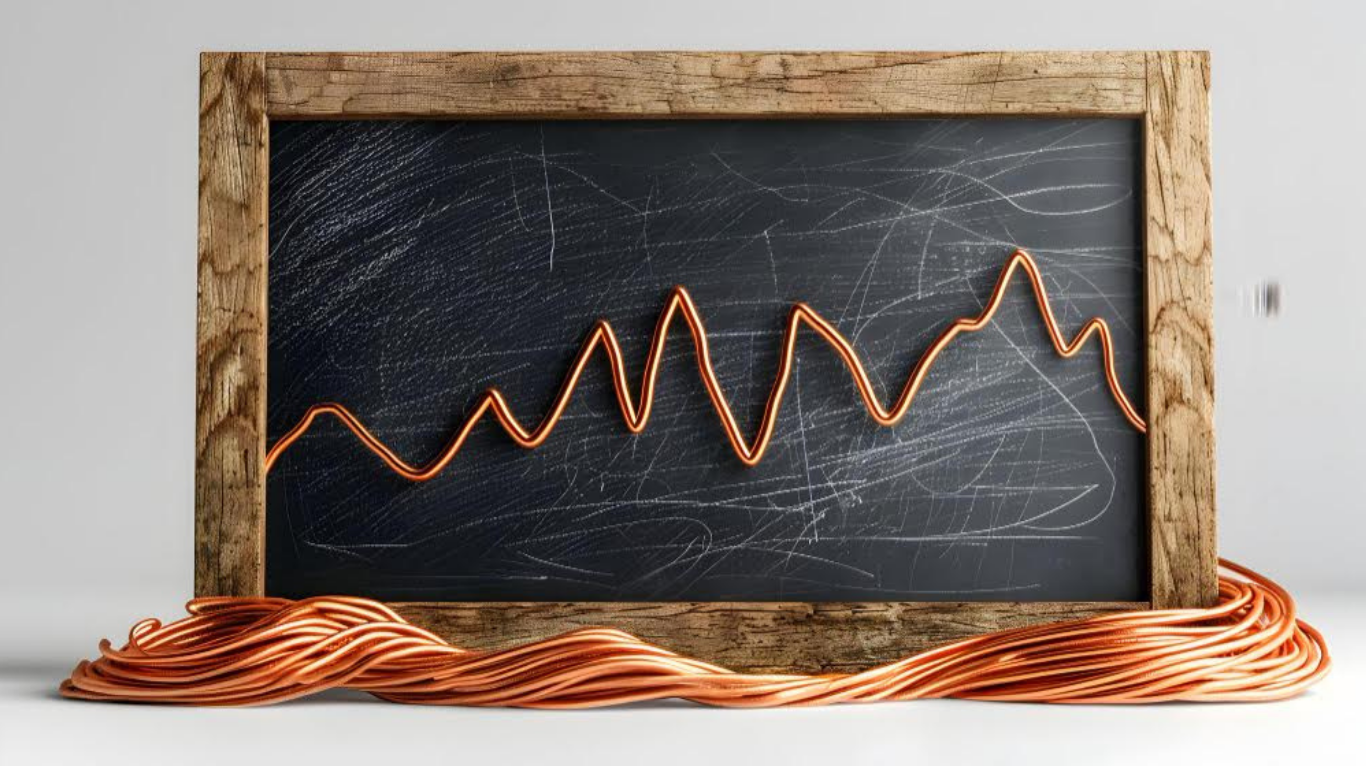

Copper is one of the most sensitive commodities to economic cycles, often called “Dr. Copper” for its ability to predict growth or slowdowns. The live copper price reflects demand from construction, electronics, EVs, and renewable energy infrastructure. Spikes in copper prices usually signal accelerating industrial activity or supply disruptions, while drops indicate weakening demand or oversupply. In current market conditions, copper’s volatility provides traders with clear signals about global manufacturing and infrastructure trends. This article explains what drives copper price spikes, how to read them, and what they mean for broader markets.

Supply and Demand Imbalances as Primary Triggers

Copper price spikes often stem from supply disruptions. Mining strikes in Chile or Peru, which produce over 30% of global supply, can reduce output and push prices up 5-10% in weeks. Weather events or energy shortages in key regions add pressure.

Demand surges are another driver. China’s infrastructure spending or global EV production ramps lift consumption sharply. A 1% increase in global GDP growth can add 0.5-1% to copper demand, translating to significant price moves.

Inventory data from LME and SHFE warehouses shows real-time supply pressure. Draws in stocks signal tightness, often triggering spikes, while builds indicate oversupply.

Macroeconomic Factors Influencing Copper Volatility

Economic growth expectations move copper fast. Strong PMI readings in China or the US boost prices as manufacturing activity rises. Weak data, like slowing construction or factory output, causes drops.

Dollar strength plays a big role. Copper is priced in USD, so a weaker dollar makes it cheaper for non-US buyers, increasing demand and lifting prices. DXY drops of 5% historically add $0.20-0.40 to copper.

Inflation and interest rates also matter. Higher inflation favors commodities as hedges, while rate hikes strengthen the dollar and pressure copper lower.

Geopolitical and Supply Chain Risks

Geopolitical events disrupt copper supply chains. Sanctions, trade disputes, or conflicts in producing regions cause immediate spikes. Recent years showed how supply tightness from these factors can push prices 15-20% higher in short periods.

Logistics issues, like shipping delays or port strikes, add volatility. Copper’s global supply chain makes it sensitive to transportation disruptions.

These risks create trading opportunities. Spikes from supply shocks often reverse as markets adjust, offering mean-reversion plays.

| Driver | Price Impact | Typical Spike Size | Duration |

| Supply Disruption | Upward | 5-15% | Weeks to months |

| Demand Surge | Upward | 10-20% | Months |

| Dollar Weakness | Upward | 5-10% | Varies with DXY |

| Geopolitics | Upward | 10-30% | Event-dependent |

How Traders Read and Use Copper Volatility

The copper chart shows clear patterns during spikes. Breakouts above resistance with volume surge signal continuation, while exhaustion candles at highs often precede reversals.

Technical tools help. RSI above 70 indicates overbought conditions, MACD crossovers confirm momentum shifts. Support/resistance levels from recent swings guide entries.

Traders use volatility for both directional and mean-reversion trades. Long on supply shock breakouts, short on overextended rallies.

Risk management is critical. Use 1-2% risk per trade, stops below recent lows, and avoid over-leverage during spikes.

Conclusion

Copper price spikes reflect supply disruptions, demand surges, dollar moves, and geopolitical risks, making it a leading indicator of global economic activity. Traders use the chart’s patterns, volume, and technical tools to capture these moves, but volatility requires strict risk controls. In emerging markets and global cycles, copper volatility isn’t noise, it’s a signal of what’s coming next. Monitor key levels, manage position size, and stay disciplined to turn swings into consistent opportunities.

Article received via email