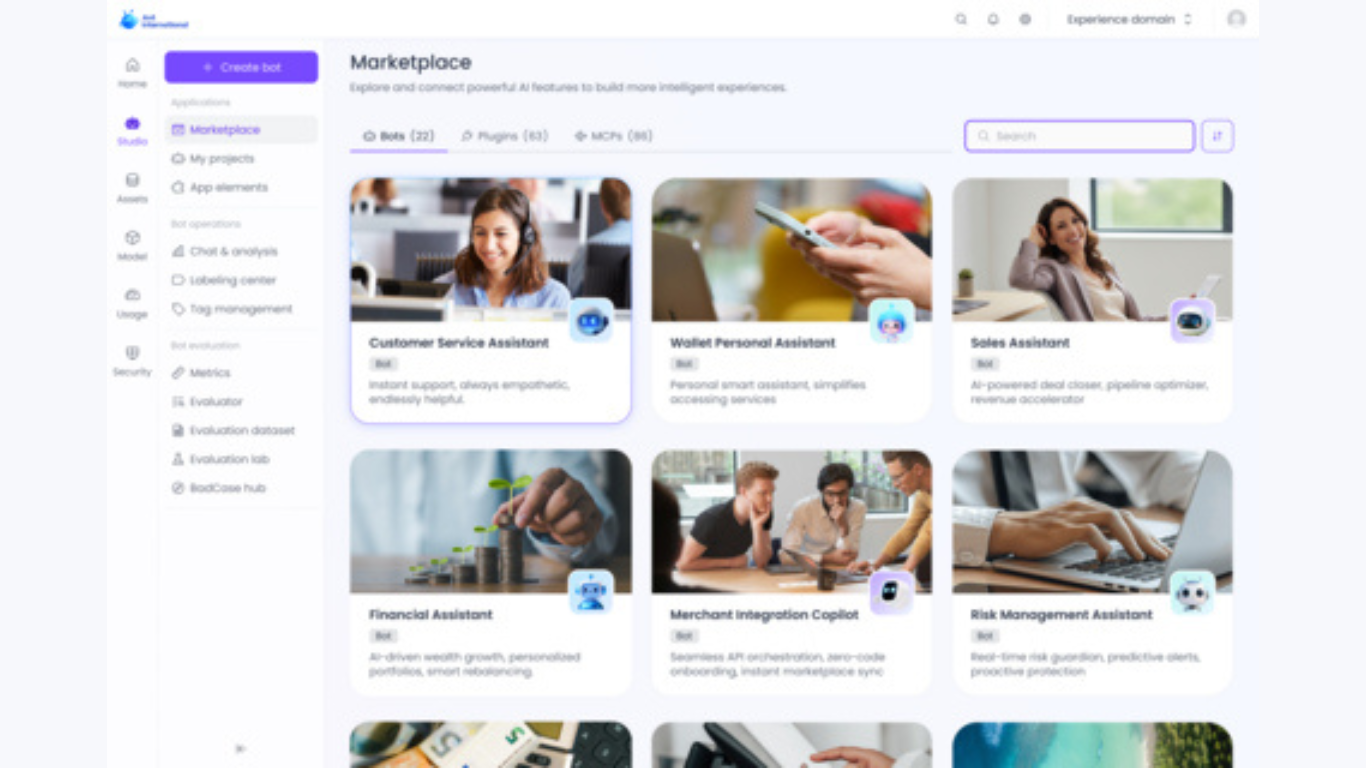

Corporate leaders increasingly view citizenship by investment (CBI) programs as strategic business tools rather than luxury lifestyle choices. Recent data from investment migration consultancies indicates a 45% increase in CBI applications from executives and entrepreneurs over the past 18 months, driven by geopolitical uncertainties and expanding global commerce requirements.

The shift represents a fundamental change in how international businesses approach operational flexibility and risk management. Companies operating across multiple jurisdictions now factor citizenship diversity into strategic planning, recognizing passport strength as a competitive advantage in global markets.

Executive Mobility Drives Demand

Technology sector executives lead CBI adoption trends, with 60% of recent applications originating from fintech, cryptocurrency, and digital platform entrepreneurs. These professionals require unrestricted travel for client meetings, regulatory negotiations, and business development across multiple continents.

Sarah Chen, CEO of Singapore-based blockchain platform TechFlow, obtained Maltese citizenship in 2024 to facilitate European market expansion. “Our regulatory discussions required physical presence across EU capitals. Visa delays were costing us competitive positioning in time-sensitive negotiations,” Chen explains.

The Caribbean dominates fast-track citizenship processing, with Antigua and Barbuda, St. Kitts and Nevis, and Grenada completing applications within 3-4 months. Processing speed appeals to executives managing quarterly business cycles and immediate market opportunities.

Investment thresholds range from $100,000 to $250,000 for Caribbean programs, representing reasonable business expenses for companies prioritizing international flexibility. European programs require higher investments—€650,000+ for Malta—but provide direct EU market access and stronger passport benefits.

Risk Mitigation and Business Continuity

Geopolitical instability drives strategic citizenship planning among multinational corporations. Companies with operations spanning politically volatile regions use CBI programs to ensure executive mobility during crisis periods.

Recent sanctions regimes and diplomatic tensions have highlighted citizenship-based travel restrictions that can paralyze international business operations. Executives holding single passports from countries experiencing diplomatic disputes face sudden travel limitations that disrupt established business relationships.

Alternative citizenship provides operational insurance against political changes that could affect business continuity. Companies increasingly budget for CBI programs as risk management expenses, similar to political risk insurance or currency hedging strategies.

Market Access and Regulatory Advantages

European citizenship through investment programs offers direct access to EU banking regulations, fintech licensing, and financial services operations. Malta’s Individual Investor Programme attracts cryptocurrency and digital asset companies seeking EU regulatory clarity and market access.

Caribbean citizenship provides strategic advantages for emerging market operations. Grenada’s unique visa-free access to China appeals to businesses developing Asian market strategies, while maintaining Western Hemisphere mobility benefits.

Banking relationships improve significantly with strong passport credentials. International financial institutions apply enhanced due diligence to clients from certain jurisdictions, creating operational friction for global businesses. Investment citizenship often resolves these compliance challenges.

Tax Optimization and Corporate Structure

CBI programs enable sophisticated tax planning structures for international businesses. Caribbean jurisdictions typically don’t tax foreign-sourced income, appealing to entrepreneurs with globally distributed revenue streams.

Portugal’s Golden Visa program attracts business leaders through its Non-Habitual Resident tax regime, offering significant advantages for qualifying professionals and investors. The combination of EU access and favorable tax treatment creates compelling value propositions for international executives.

Corporate structuring benefits include simplified asset ownership across multiple jurisdictions, streamlined estate planning for international families, and enhanced privacy protections for business owners in sensitive industries.

Sector-Specific Applications

- Technology Sector: Cryptocurrency entrepreneurs leverage CBI programs to establish regulatory clarity in favorable jurisdictions while maintaining global mobility for business development and compliance activities.

- Real Estate Development: International property developers use citizenship programs to access restricted investment opportunities and establish local market credibility in target expansion markets.

- Financial Services: Private equity and hedge fund managers obtain alternative citizenship to navigate complex international compliance requirements and access previously restricted institutional investor markets.

- Manufacturing and Trade: Import-export businesses benefit from passport strength that facilitates visa-free access to supplier countries and customer markets, reducing operational complexity and travel costs.

Due Diligence and Compliance Considerations

Enhanced due diligence requirements have intensified across all CBI programs following international pressure for transparency improvements. Business leaders must demonstrate legitimate income sources and undergo comprehensive background investigations.

Compliance costs extend beyond initial investment requirements. Legal fees, documentation expenses, and ongoing tax obligations create total investment costs significantly exceeding published program minimums.

Professional advisory services become essential for navigating complex application processes and optimizing program benefits. Industry specialists help businesses structure investments to maximize both citizenship benefits and commercial advantages.

According to leading citizenship-by-investment consultancies, proper program selection and structuring can significantly impact both approval success and long-term business benefits for international executives.

Emerging Market Trends

- Family Office Integration: Wealthy families increasingly integrate CBI planning into generational wealth strategies, considering citizenship benefits for heirs and succession planning across multiple jurisdictions.

- Corporate Citizenship Policies: Large multinational corporations develop formal policies for supporting executive citizenship acquisition, recognizing strategic business benefits and competitive advantages.

- Regulatory Evolution: Program requirements continue evolving as jurisdictions balance revenue generation with international compliance pressures and reputation management concerns.

Strategic Implementation Framework

- Assessment Phase: Companies evaluate executive travel patterns, market expansion plans, and regulatory requirements to identify optimal citizenship programs for business objectives.

- Investment Planning: Financial structuring ensures CBI investments align with corporate investment strategies and provide measurable returns beyond citizenship benefits.

- Timeline Coordination: Business leaders coordinate application timelines with market expansion schedules, regulatory deadlines, and corporate strategic planning cycles.

- Integration Strategy: Successful implementation requires integrating citizenship benefits into broader corporate mobility policies and international expansion strategies.

Future Outlook and Market Development

Industry analysts project continued growth in business-driven CBI applications as international commerce becomes increasingly complex and geopolitically sensitive. Companies that establish citizenship diversity early gain significant competitive advantages in global market access and operational flexibility.

New program developments focus on attracting specific business sectors through tailored investment options and accelerated processing for qualified commercial applications. Competition among jurisdictions drives program improvements and expanded benefits for business applicants.

The evolution from lifestyle-driven to strategy-driven citizenship investment reflects broader changes in international business operations. Companies operating in multiple jurisdictions increasingly recognize citizenship planning as essential infrastructure for global competitiveness.

As international business continues expanding across traditional boundaries, strategic citizenship acquisition provides competitive advantages that extend far beyond personal convenience to fundamental business capability and market access optimization.

Blog received via Mail