Accidents happen in offices, shops, warehouses, and on the road. A slip on a wet floor or a fender bender with a delivery van can turn into claims, costs, and stress. What you do before and after an incident makes a real difference.

If your team operates in Texas or works with Spanish-speaking staff and customers, many leaders in Houston look to El Abogado Domingo Garcia for clear next steps after an accident. The basics below fit most business settings and help you protect people, control risk, and keep work moving.

Duty Of Care: What It Means

Every business must act with reasonable care. This means you take sensible steps to prevent harm. You do not have to be perfect. You must do what a careful business would do in the same situation.

Make this practical. Create simple safety rules. Train people, then record attendance. Fix hazards fast and keep time-stamped photos. Save maintenance work orders. These small habits show that you take safety seriously.

In many claims, these records decide who pays and how much.

Negligence is not only about what went wrong. It is also about what you did right. Written policies, training logs, and proof of repairs are strong evidence. They can reduce or even avoid liability.

Keep Your Property Safe

If you invite customers, vendors, or visitors onto your site, you must keep it reasonably safe. Wet floors, poor lighting, loose mats, and broken steps often lead to injuries.

Use a short, daily checklist. Assign a person by name, not just a department. Walk the site at set times.

If someone finds a hazard, they should fix it or mark it, then log what they did. Put wet floor signs out quickly. Replace bulbs. Tighten or remove loose mats. The goal is simple, safe, and documented.

Think about security as part of safety. Poor lighting in parking areas, broken locks, or out-of-service cameras increase exposure if a theft or assault occurs.

Keep a schedule for light checks, camera tests, and door hardware. Record each check. When something breaks, fix it and note the date and time.

Company Vehicles And Crashes

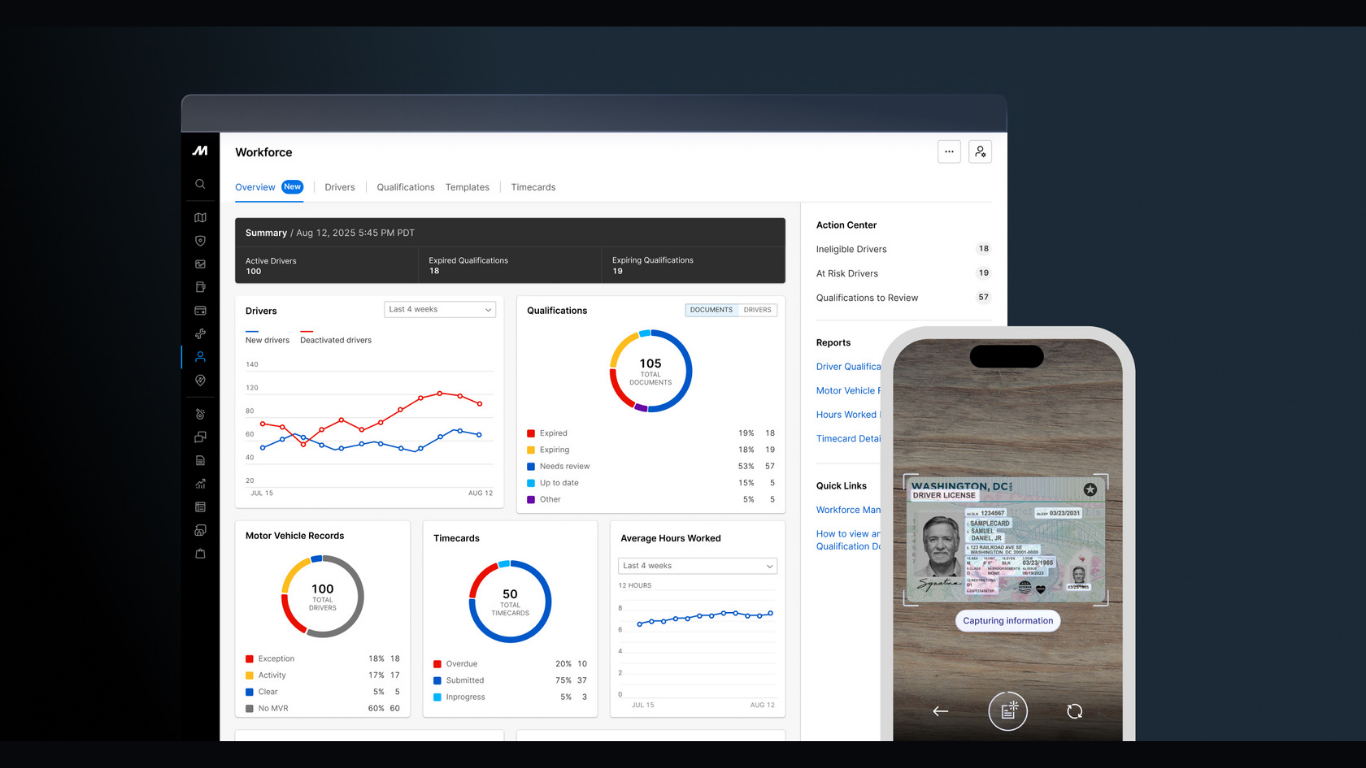

Company cars, vans, and even staff who drive their own vehicles for work can create liability after a crash. Screen drivers before they start. Keep copies of licenses. Run motor vehicle record checks. Train on speed control and distracted driving. Require seat belts, no exceptions.

Make a one-page crash kit for the glove box. Include steps to call emergency services, exchange information, take photos, gather witness names, and notify your safety lead. Quick, accurate facts reduce disputes later.

Service your vehicles on a set schedule. Save receipts for tires, brakes, and recalls. Use a shared folder for inspection logs and photos.

Employees, Contractors, And Liability

A company can be responsible for what employees do while doing their jobs. This is often called vicarious liability. If a delivery driver causes a crash during a route, the claim may point to your business, not just the driver.

Independent contractor labels do not always protect you. Courts look at control. If you control hours, tools, and methods, a contractor may be treated like an employee.

Use clear contracts. Require general liability insurance, auto coverage if driving is involved, and workers’ compensation when applicable. Ask for certificates each year and keep them in a central folder with renewal reminders.

Workers’ compensation covers most injuries to employees on the job, often without proving fault. It may limit lawsuits by employees against the employer. Rules differ by state and country. Confirm which sites and roles must be covered. Post required notices where staff can see them.

An injured worker can still bring a claim against a third party, such as a property owner or another driver. Your insurer may recover some costs from that third party. Train managers to report all outside parties involved in an incident so your insurer can act quickly.

After An Incident: Save Evidence And Report

Facts fade fast. Make a simple response plan that every manager understands.

First, help the injured person and call emergency services if needed. Then secure the area. Take photos of the floor, lighting, warning signs, footwear, vehicles, equipment, and any liquids or debris.

Save security footage the same day. Export a copy and keep the original device or drive if you can.

Write down names and phone numbers for witnesses and staff on duty. Note the time, weather, and temporary fixes. Do not repair, clean, or throw out a product or tool that may have caused harm until your insurer or attorney agrees. Store it safely and label it.

Avoid guessing about causes. Stick to facts. Quick opinions often sound wrong later and can hurt your case.

In many places, you must report serious injuries to a regulator within set time frames. In the United States, employers must report in-patient hospitalizations, amputations, or loss of an eye to OSHA within specific deadlines.

Claims have filing deadlines. In many U.S. states, general personal injury claims must be filed within two years. Some deadlines are shorter or longer.

If you operate across states, build a simple chart with common deadlines and review it yearly with counsel. Where a case is filed also matters. Contract clauses can set venue and governing law. Keep those clauses standard and up to date.

Contact your insurer right away after a serious incident. Late notice can complicate coverage. Train managers to inform your safety lead the same day and send written notice to the carrier through your broker.

30 To 90 Day Action Plan

You do not need a huge manual to make progress. Start with three actions in the next 30 days.

First, set daily site checks with a two-minute checklist and a photo. Second, update your vehicle crash kit and train drivers on the steps. Third, create a shared folder for incident reports, training logs, service receipts, and insurance certificates.

Make sure managers know where it is and how to use it.

Then plan three actions for the next quarter. Review contractor agreements and insurance certificates.

Host a one-hour refresher for managers on first response and evidence preservation. Update your chart of reporting rules and claim deadlines and place it in your manager portal.

If an incident occurs and your team needs help with Spanish-language support, consider early contact with a firm experienced in accident investigations, medical record gathering, and insurer talks.

In Houston, many managers rely on resources from the office linked above to explain next steps to staff and to line up claim documents without delay.

A steady routine, clean records, and quick response will not stop every incident. They will reduce disputes, cut costs, and keep your focus on people and operations.

Takeaway

Put this into practice now. Inspect daily. Train quarterly. Keep clear records. Call your insurer and counsel fast after any serious injury. These steps protect people first and make the legal process easier to manage.

Blog received via Mail