Running a business means juggling people, equipment, and deadlines while trying to keep everyone safe. Protection plans give structure to that chaos, helping you prevent injuries and limit financial shocks. They show workers that safety is not a slogan – it is part of how the company operates daily.

Why Protection Plans Matter

Injury and illness trends remind us that strong plans are not optional. A recent government report noted that private employers recorded millions of nonfatal cases across the country in 2024, even with a slight decline from 2023. That means owners and supervisors need a plan that goes beyond a policy binder.

Good plans do two jobs at once. They reduce the odds of harm through training, safe equipment, and clear roles.

Here is a simple checklist to pressure test your current setup:

- Name the top 3 hazards in each job role and list how you control them.

- Match every common risk to a policy or procedure that pays for it.

- Schedule quarterly drills and refreshers so the plan stays real.

Core Policies Every Business Should Weigh

Start with workers’ compensation, general liability, and commercial auto if vehicles are part of the work. Add employment practices liability to protect against claims tied to hiring, firing, or harassment.

Some businesses layer in occupational accident or disability coverage, especially where state rules give employers flexibility. Choose deductibles and limits that fit your cash flow and risk tolerance.

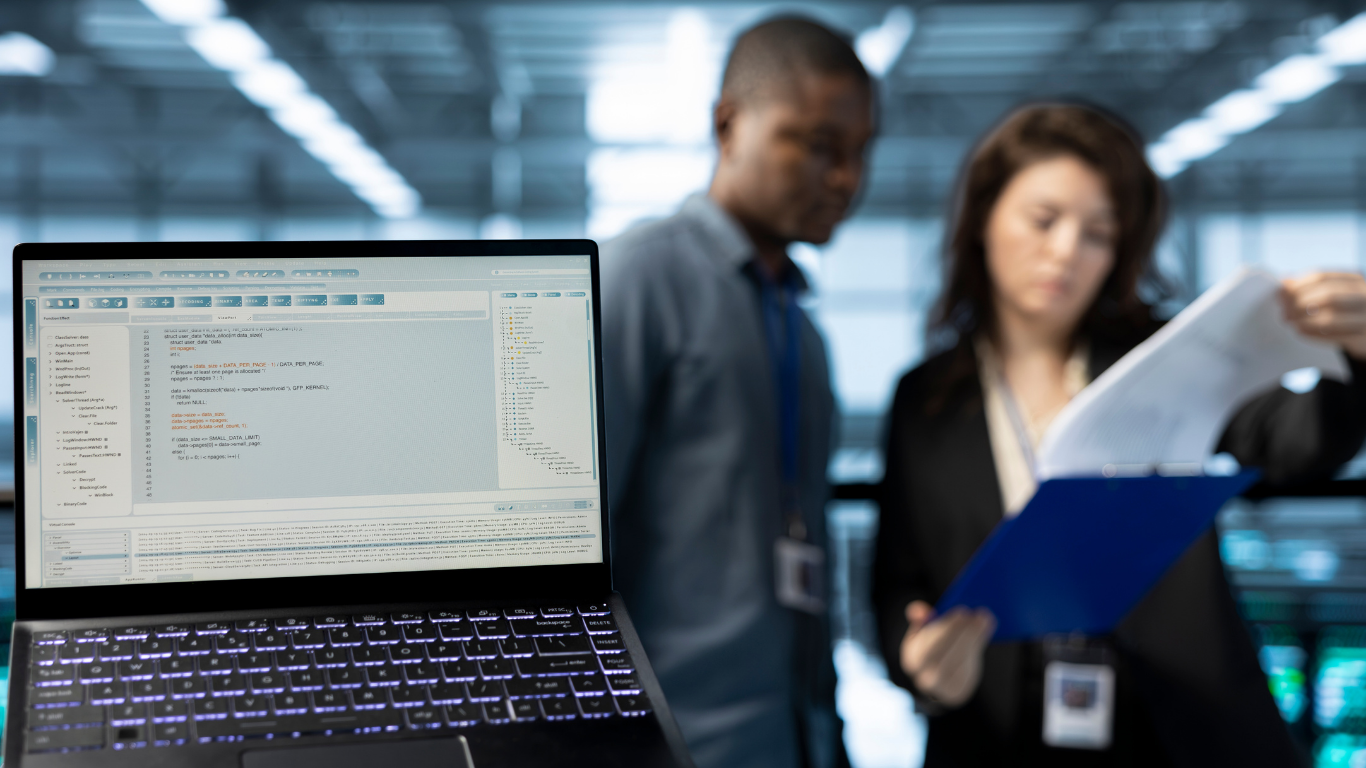

Many owners keep a trusted advisor on call. A Work Injury Lawyer can help translate policy language into real-world protection, especially after a serious incident. That expertise becomes crucial when claims cross over between comp, liability, and third parties.

Workers’ Compensation Basics And Options

Workers’ comp is the backbone for most employers because it pays medical care and part of lost wages after a job-related injury. States set the rules, but the core idea is the same – a no-fault system that trades quick benefits for limits on lawsuits.

Some jurisdictions allow alternatives or carve-outs. If you are exploring different structures, compare the benefit design, provider networks, and dispute timelines side by side.

Remember that comp interacts with leave laws and disability policies. Align HR, safety, and insurance so workers are not bounced between programs or left waiting for approvals.

Safety Programs That Reduce Risk

Prevention multiplies the value of any policy. Focus on practical controls like machine guarding, fall protection, and lockout/tagout on maintenance tasks.

Data-driven safety helps you target fixes faster. One federal agency reported receiving hundreds of thousands of annual injury summaries on a single form, which highlights how common patterns can be across industries.

Train in short, frequent sessions. New hires need a focused onboarding plan, while veterans benefit from refreshers that cover near misses and lessons learned. When people see training tied to real incidents, attention goes up, and shortcuts go down.

Handling Incidents And Reporting

Respond with care first and paperwork second, but do both quickly. Make sure supervisors know who calls emergency services, who handles scene control, and who documents what happened.

Accurate logs are not just compliance tasks. Regulators have explained that wider access to establishment-specific injury data helps workers, employers, and the public make smarter safety choices.

Assign one person to their own timelines for internal and external reports. Keep backups of forms, witness notes, and photos. After the dust settles, hold a brief review to agree on the root cause and the fix, then share the change with the full team.

Cost Control And Budget Planning

Think of costs in layers – premiums, deductibles, indirect costs like overtime, and the price of safer equipment. A single injury can trigger all four. Budget a small reserve for immediate fixes so you do not delay changes that would prevent the next one.

Use your insurer’s loss runs to see where money leaks. If strains and sprains dominate, invest in material handling aids and short micro-breaks.

Finally, partner with your broker, carrier, and clinic to set shared goals. If you can cut lost time days and speed up transitional duty, claim costs fall and premiums often follow.

Good protection plans are not a stack of forms. They are everyday habits backed by the right coverage and clear playbooks. When owners and workers build those habits together, risk drops and confidence grows.

Make this the year you simplify policies, sharpen training, and clean up reporting so everyone knows what to do. Small steps add up quickly, and the payoff shows up in safer shifts, steadier schedules, and fewer surprises.

Article received via email