The journey toward business prosperity requires more than just tracking revenue and expenses. Modern entrepreneurs must develop a comprehensive understanding of their company’s financial health to make informed decisions and secure future growth opportunities.

The Foundation of Financial Health

Every successful business relies on strong financial management. While profitability remains crucial, savvy business owners recognize that sustainable growth demands a deeper look into various financial indicators. These metrics serve as early warning systems, helping identify potential challenges before they become critical issues.

Key Performance Indicators That Matter

Financial health indicators go far beyond traditional profit and loss statements. They encompass a wide range of metrics that paint a complete picture of your business’s stability and potential:

- Operating Cash Flow Ratio

- Working Capital Management

- Accounts Receivable Turnover

- Debt-to-Equity Ratio

- Gross Profit Margin

- Customer Acquisition Cost

Building Credibility with Financial Institutions

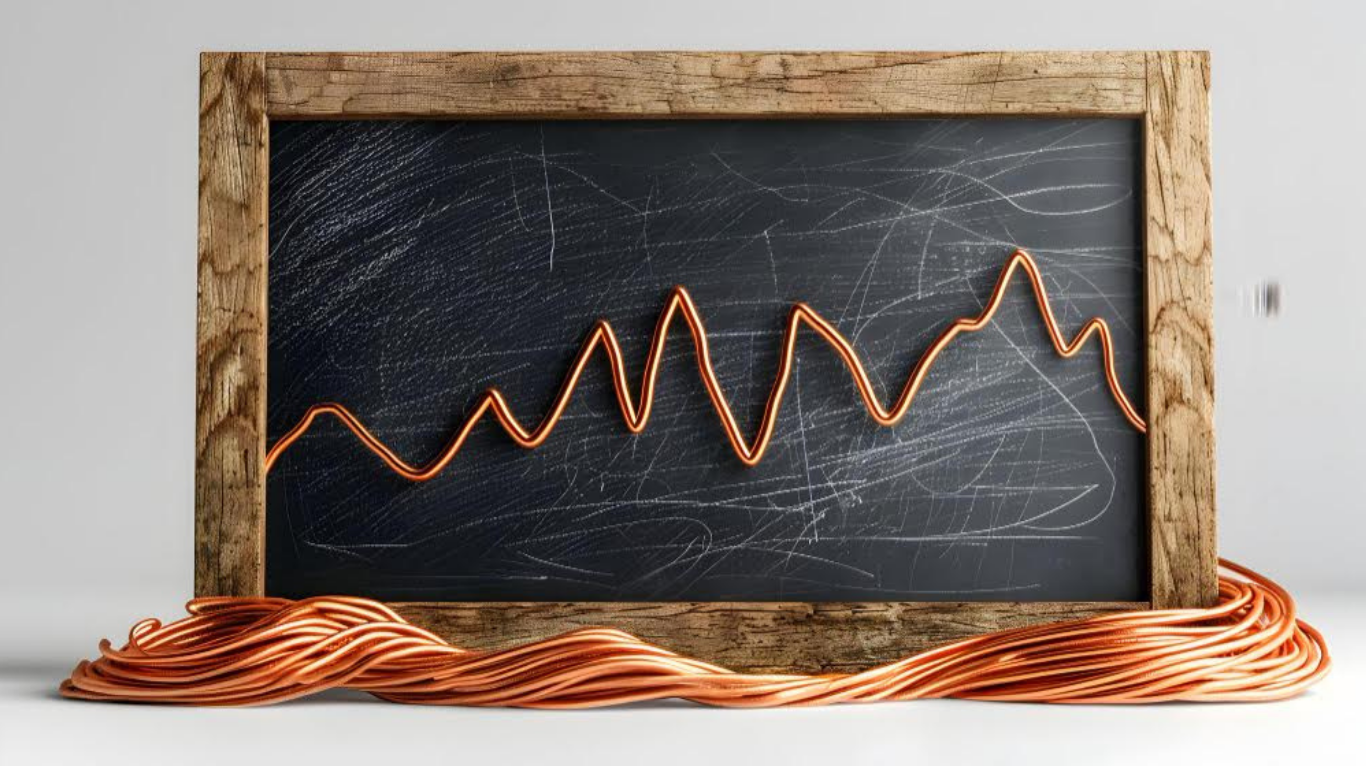

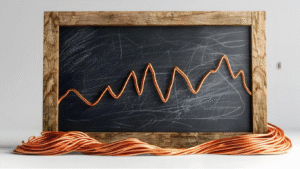

Your company’s financial health becomes particularly crucial when seeking business expansion opportunities. Lenders evaluate multiple factors, including your credit score chart and payment history, to assess your business’s financial situation. They’re equally interested in your business’s operational efficiency, market position, and growth trajectory.

Leveraging Technology for Financial Monitoring

Modern financial technology provides unprecedented access to real-time data analysis. Cloud-based accounting systems, integrated banking platforms, and automated reporting tools enable business owners to constantly track their financial health. This technological integration allows for more proactive decision-making and strategic planning.

The Role of Working Capital

Working capital management stands as a critical indicator of business health. It reflects your company’s ability to meet short-term obligations while funding ongoing operations. Efficient working capital management ensures smooth business operations and demonstrates financial competence to stakeholders and potential investors.

Risk Management and Financial Stability

Understanding your financial health indicators enables better risk management strategies. By consistently monitoring these metrics, businesses can identify potential risks and implement mitigation strategies before problems escalate. This proactive approach helps maintain stability during market fluctuations and economic uncertainties.

Future-Proofing Your Business

Financial health monitoring isn’t just about current stability; it’s about preparing for future opportunities and challenges. Regular assessment of financial indicators helps businesses adapt to changing market conditions and position themselves for sustainable growth. This forward-looking approach enables companies to capitalize on opportunities while maintaining operational resilience.

Creating Sustainable Growth Patterns

The most successful businesses use their understanding of financial health indicators to create sustainable growth patterns. By balancing expansion ambitions with financial stability, companies can avoid expanding too quickly without an adequate financial foundation.

Building Stakeholder Confidence

Strong financial health indicators build confidence among all stakeholders – from employees and suppliers to investors and customers. When businesses demonstrate consistent financial competence, they attract better partnerships, more favorable terms from suppliers, and increased customer trust.

Conclusion

Understanding and actively monitoring your business’s financial health indicators is fundamental to modern business management. Success in today’s competitive landscape requires more than intuition; it demands a data-driven approach to financial management. By maintaining a comprehensive view of your company’s financial health, you position your business for sustainable growth and long-term success. Remember, financial health monitoring is not a one-time exercise but a continuous process that evolves with your business’s growth and changing market conditions.

Article received on email