The traditional payment voucher, once a cornerstone of manual accounting processes, is undergoing a revolutionary transformation in the digital age. Organizations worldwide are moving away from paper-based voucher systems toward sophisticated digital solutions that streamline financial operations, improve accuracy, and provide real-time visibility into payment processes.

Understanding Digital Payment Vouchers

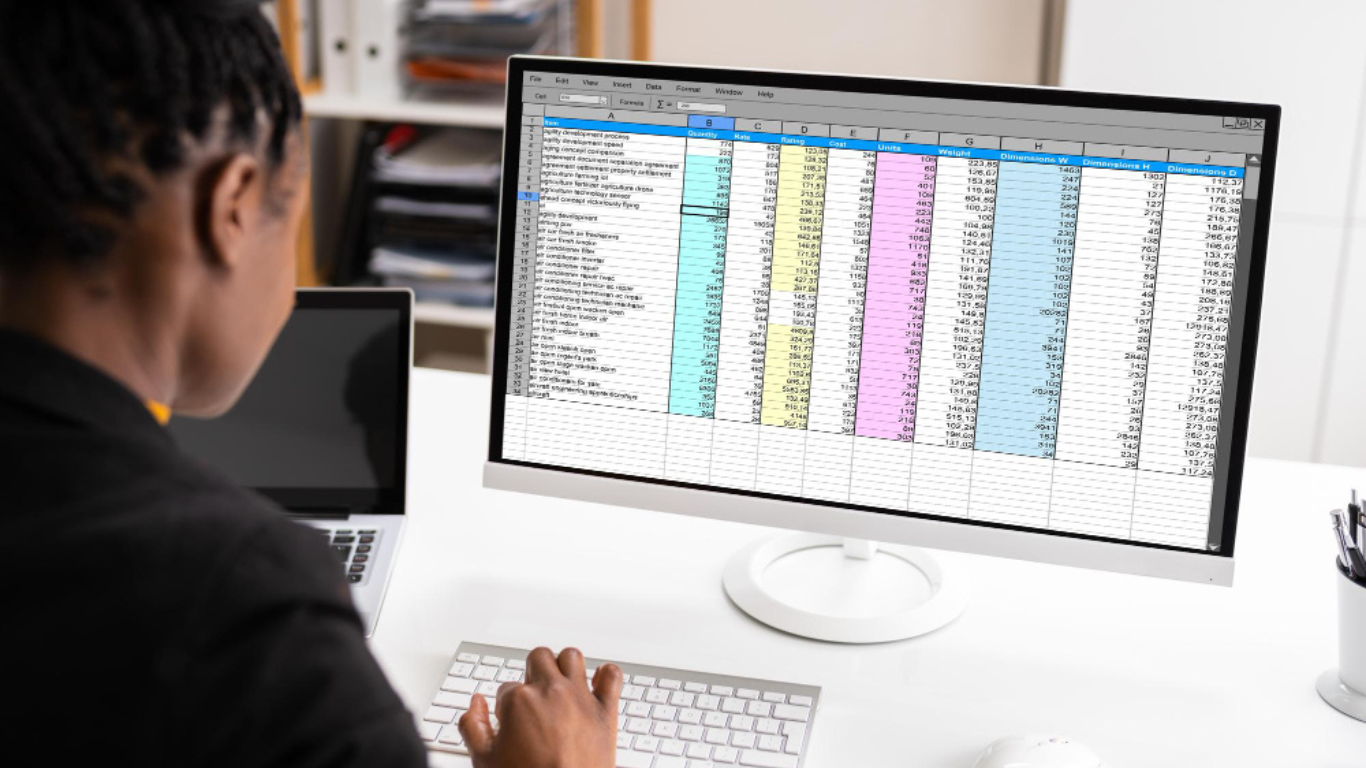

Digital payment vouchers represent the electronic evolution of traditional authorization documents used to approve and track payments. Unlike their paper predecessors, digital vouchers exist within integrated software systems that connect accounting, procurement, and approval workflows seamlessly. These electronic documents maintain all the essential functions of traditional vouchers while adding layers of automation, security, and analytical capabilities.

The digitalization process transforms static paper documents into dynamic, interactive tools that can route automatically through approval hierarchies, integrate with accounting systems, and provide instant status updates to all stakeholders involved in the payment process.

Key Advantages of Digital Transformation

Improved Efficiency and Speed: Digital voucher systems eliminate time-consuming manual processes such as physical document routing, manual data entry, and paper filing. Automated workflows can route vouchers through approval chains in minutes rather than days, significantly accelerating payment processing times. This speed improvement directly impacts vendor relationships and can often secure early payment discounts.

Improved Accuracy and Reduced Errors: Manual data entry errors, which can cost organizations thousands in corrections and reconciliation efforts, are virtually eliminated through automated data capture and validation. Digital systems can automatically populate voucher fields from purchase orders, invoices, and vendor databases, ensuring consistency and accuracy across all payment documents.

Superior Audit Trail and Compliance: Digital vouchers create comprehensive, immutable audit trails that track every action, approval, and modification throughout the payment lifecycle. This transparency simplifies compliance reporting and provides auditors with clear, searchable records that demonstrate proper internal controls and authorization procedures.

Implementation Strategies

System Integration: Successful digital voucher implementation requires seamless integration with existing enterprise resource planning (ERP) systems, accounting software, and procurement platforms. Organizations should prioritize solutions that can communicate effectively with their current technology stack while providing APIs for future integrations.

Workflow Customization: Digital voucher systems must accommodate unique organizational approval hierarchies and business rules. Configurable workflows allow companies to replicate their existing approval processes while taking advantage of automation opportunities. This includes setting up automatic routing based on payment amounts, vendor categories, or departmental requirements.

User Training and Change Management: The transition from paper to digital vouchers requires comprehensive training programs that help employees understand new processes and system capabilities. Change management strategies should address resistance to new technology while highlighting the personal and organizational benefits of digital transformation.

Security and Risk Management

Digital voucher systems incorporate advanced security measures, including role-based access controls, encryption, and multi-factor authentication. These features provide superior protection compared to paper-based systems, which can be easily lost, copied, or manipulated without detection.

Automated approval limits and segregation of duties can be enforced systematically, reducing the risk of fraudulent payments while ensuring appropriate oversight at every level of the payment process.

Future Outlook

The digitalization of payment vouchers represents just the beginning of a broader financial process transformation. Emerging technologies such as artificial intelligence and machine learning are beginning to add predictive capabilities, automated exception handling, and intelligent document processing to digital voucher systems.

As organizations continue to embrace digital transformation, payment voucher digitalization serves as a foundation for more comprehensive financial automation initiatives. The benefits of improved efficiency, accuracy, and visibility make this transformation not just advantageous but essential for competitive business operations in the modern economy.

Article received via email