Importers sourcing from China often face inflated costs when suppliers quote in USD to cover conversion risks. A 48-hour delay in a supplier payment can trigger a 2-week supply chain collapse. Direct access to local currency channels changes that by cutting unnecessary layers.

Online money transfer services make this possible by providing fast, direct paths to CNY and other currencies without the traditional banking layers.

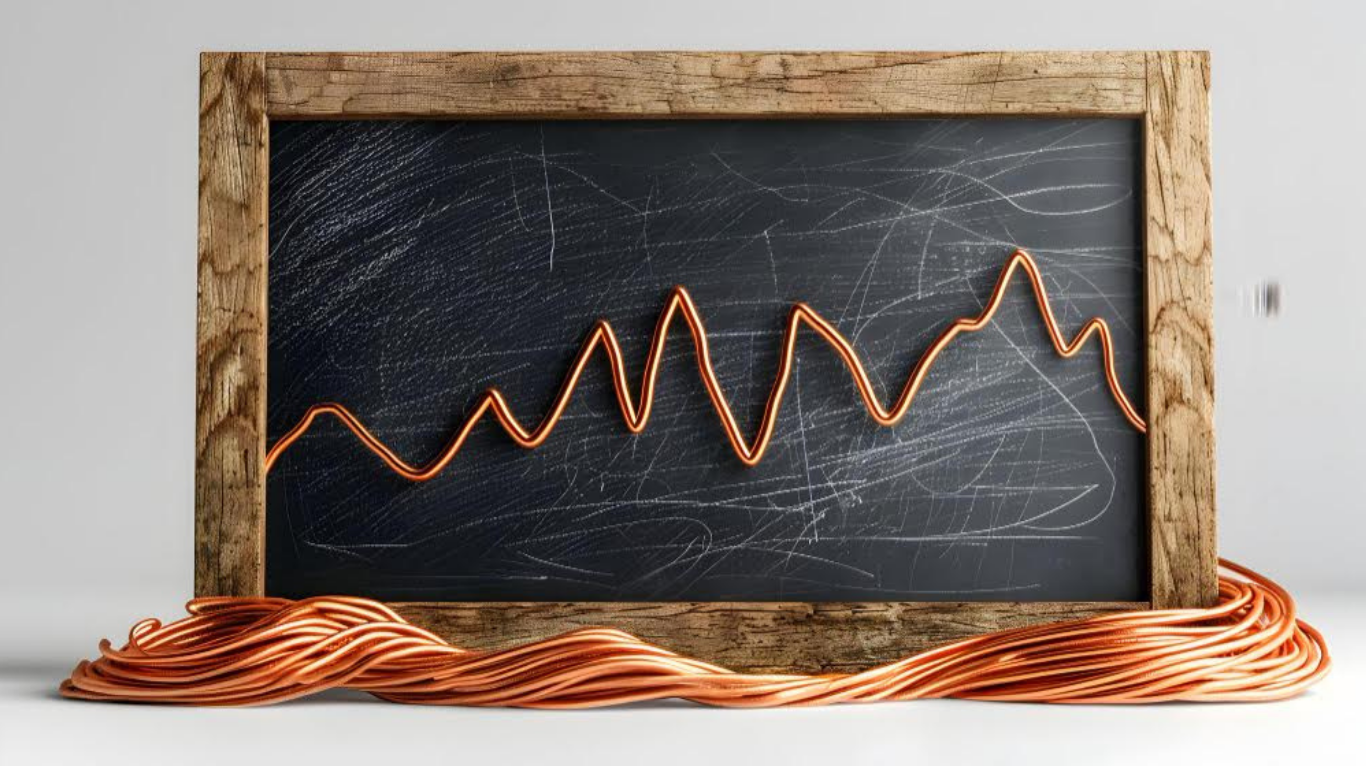

Why currency transfers are one of the biggest pain points for importers

Suppliers from various regions demand payments in their preferred currencies, such as CNY for Chinese factories or EUR for European manufacturers. Deadlines for shipments leave no margin for errors. Banking holds turn into tangible losses, like penalties for late container releases or eroded trust with partners. For UAE-based importers dealing with Asia, these frictions compound when handling packing lists and invoices that require swift confirmation.

How import payments actually work — beyond bank brochures

An importer initiates a transfer, but the funds route through multiple correspondent institutions via SWIFT gpi for tracking. Each intermediary adds verification steps, often charging $25–50 per leg. Time accumulates in queues, and conversions erode value. For AED-to-CNY flows, traditional setups involve 3-4 hops, leading to days of float where funds sit unproductive.

The hidden cost of traditional bank transfers in multiple currencies

Multiple conversions inflate spreads by 2–5% above market rates. Fees surface post-transaction, including those from intermediaries. The delay between dispatch and receipt locks capital, forcing importers to maintain buffers. When Chinese suppliers invoice in USD, they embed a 3–5% premium for their own conversion risks—paying directly in CNY via regulated channels avoids this markup entirely.

Why importers need speed and predictability — not just “international transfers”

Consistent timelines outweigh nominal low fees, as payment lags disrupt logistics and supplier negotiations. A single-currency focus requires repeated exchanges, unfit for diverse trade. Importers require a structure that supports real operations, like settling invoices tied to actual goods without speculative delays.

What an efficient multi-currency payment setup looks like for importers

Control spans accounts in essential currencies like USD, EUR, AED, GBP, and CNY from one dashboard. Exchange rates track interbank levels in real time. Settlements follow clear schedules, with full visibility over flows. This setup ties directly to trade documents, ensuring funds align with economic activity.

How Shokran simplifies multi-currency transfers for import businesses

As a regulated fintech platform and Islamic neobank, Shokran grants access to multi-currency infrastructure with zero minimum balance requirements. Fixed, transparent fees replace hidden charges, and revenue adheres to Shariah principles through service-based models rather than interest. No penalties apply to delayed settlements, and zero hidden float costs maintain fairness. For those prioritizing ethical alignment, Islamic banking like this foster shared responsibility in trade partnerships.

Real import scenarios where Shokran makes a difference

A Dubai importer settles weekly CNY payments to Shenzhen factories, matching invoices and packing lists without USD premiums. For urgent adjustments, like scaling orders mid-production, funds arrive T+0 or T+1. Handling parallel EUR payments to Italian component suppliers occurs without cross-conversions. Human-led compliance support ensures that your invoice isn’t flagged by a mindless algorithm at 2 AM, keeping Chinese fabrication lines active.

Compliance without delays: How Shokran keeps transfers moving

Verifications center on trade essentials—company certificates, director proofs, and transaction documents—to confirm legitimacy. Steps are outlined clearly: what gets reviewed, at which stage, and why decisions follow. This balances oversight with momentum, drawing on Shariah’s emphasis on transparent contracts and ethical screening to exclude non-compliant activities.

Who Shokran is best suited for among importers

Designed for SMEs moving $100k – $1M+ monthly who are tired of retail-grade banking limits. It aids growing operations with cross-border suppliers, especially those relocating to the UAE or facing traditional refusals. Businesses focused on predictable access rather than full banking find it practical. Purely domestic setups or those avoiding regulations may seek alternatives.

| Characteristic | Traditional bank (Tier 1) | Shokran (Islamic fintech) |

| Hidden commissions | $25-100 (Intermediary fees) | 0 (Transparent fixed fee) |

| Exchange rate | +2% – 5% from market | Interbank / Real-time rates |

| Speed to China | 3–5 working days | T+0 or T+1 (Direct CNY) |

| Minimum balance | Usually from 50,000 AED | 0 AED |

| Ethics | Commercial gain | Shariah-compliant (Fair trade) |

Conclusion: Turning currency transfers into a competitive advantage

Solid payment infrastructure bolsters import efficiency. By addressing conversion premiums and intermediary drags, importers secure better supplier terms and maintain cash flow. Shokran delivers staged access grounded in transparency and Shariah compliance, aiding sustainable expansion. Over 100 businesses use it for these flows. Consider Islamic banking solutions to align your operations with fair principles.

Article received via email