Supply-chain teams face brutal uncertainty. A factory shutdown halfway around the world can empty shelves in days, yet customers still expect Amazon-style tracking and next-day certainty—even for chemicals or heavy equipment, according to an MCA Connect industry analysis.

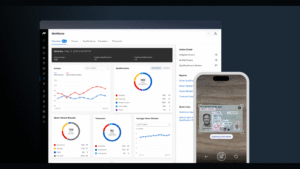

Cloud-native platforms now fuse planning, execution, and live analytics. They flag trouble early, model options in seconds, and trigger action before a hiccup turns into a headline.

We parsed 24 analyst reports, 400 peer reviews, and 30 practitioner interviews to surface the four platforms worth your shortlist. Let’s bridge promise and practice.

How we picked the four that matter

Our first filter was blunt: would a chief supply-chain officer put this tool on a million-dollar shortlist today?

We reviewed 24 analyst reports, sifted through more than 400 peer reviews, and interviewed 30 practitioners who run these platforms daily. Gartner’s 2023 Magic Quadrant still places Kinaxis, Blue Yonder, and Oracle in the Leaders quadrant, a useful signal of market relevance, according to Solutions Review.

Our practitioner lens came from MCA Connect’s post-implementation scorecards, drawn from manufacturers such as an advanced-composites producer that left spreadsheets behind for AI-driven planning and saw forecast accuracy leap 64 percent while forecast error fell 54 percent in just eight months. Those hard numbers line up with a broader shift on the demand side: more than 90 percent of digital-native consumers now begin purchases online and expect the same one-click visibility when they buy industrial equipment.

MCA Connect unpacks how to meet those rising expectations through seamless B2C experiences in B2B.

Those field-level deltas showed us which “time-to-value” claims survive plant-floor reality, so we weighted that factor more heavily in the final rankings.

Next, we scored each contender across four weighted factors: market adoption, functional breadth, innovation pace, user satisfaction, integration ease, time-to-value, and total cost of ownership. Platforms that performed well in most categories moved forward, while one-trick options shifted to the honorable-mention pool.

We pressure-tested the scores with field stories. When a glossy demo collapsed in a warehouse or a boardroom, the platform lost points fast.

The result is a data-backed, experience-tempered top four you can use as a reliable starting point.

Platform 1: SAP Digital Supply Chain Suite

SAP sets the benchmark for end-to-end coverage. Its Digital Supply Chain suite layers advanced planning, real-time analytics, and shop-floor execution on the same foundation that runs S/4HANA finance and procurement.

That single data model counts. Forecast tweaks flow into production schedules, warehouse tasks, and transportation plans without brittle middleware or duplicate tables. When demand spikes, planners see the capacity hit instantly and can run a fresh scenario in minutes instead of overnight.

Breadth is the draw. Integrated Business Planning handles demand, inventory, and S&OP. Extended Warehouse and Transportation Management keep goods moving. New sustainability plug-ins calculate carbon at the product level so you can swap routes or suppliers with the planet in mind.

The trade-off is complexity. SAP rewards teams that already speak its language; newcomers face a steep learning curve and enterprise-scale price tag. Most firms roll out modules in waves, starting with IBP, then moving to execution, so value lands sooner while skills ramp up.

For global manufacturers already invested in SAP ERP, the suite feels like a natural evolution, not a rip-and-replace. It delivers unified data, proven scalability, and quarterly cloud releases that keep updates flowing without disruptive upgrades.

Bottom line: if you want one vendor to span planning to pallet, and your backbone is SAP, this is the most comprehensive path on the market.

Platform 2: Oracle Fusion Cloud SCM

Oracle rebuilt its entire supply-chain stack in the cloud more than ten years ago, and the move is paying off.

Fusion Cloud SCM unites planning, manufacturing, logistics, and finance on one real-time ledger. When a planner tweaks the demand plan, the system instantly recalculates available-to-promise dates, reroutes shipments, and updates the P&L. No overnight batch jobs, no swivel-chair reconciliation.

Artificial intelligence works quietly beneath the surface. Adaptive algorithms flag supply-risk hotspots, predict lead times, and suggest alternate suppliers before delays bite. The new Redwood interface presents those insights clearly for planners and executives.

Oracle delivers the most value when you commit fully. Companies already running Fusion ERP see the lowest integration lift and the fastest payback. Mixed IT estates can connect, but Oracle-to-Oracle remains the smoothest path.

If your roadmap calls for a cloud-only suite that scales from regional rollout to global command center, Fusion Cloud SCM belongs on the shortlist.

Platform 3: Blue Yonder Luminate

Blue Yonder’s Luminate platform links planning smarts to execution power.

Its machine-learning models sense demand shifts, refresh supply plans, and feed updated orders into its own warehouse and transportation modules. That closed loop keeps shelf availability high while labor and freight costs stay lean.

Retailers and consumer-goods leaders value the retail pedigree: precise allocation tools, omnichannel order routing, and a control tower that flags late inbound shipments before stores feel the pain. Manufacturers tap the same AI core for inventory and capacity smoothing.

The move from on-premise JDA suites to cloud Luminate is well underway. Customers making the shift report faster upgrades and a cleaner interface, though data cleanup can test patience.

If you want best-of-breed planning plus WMS and TMS in one stack, and you run a demand-driven business where every shelf matters, Blue Yonder is a strong contender.

Platform 4: Microsoft Dynamics 365 Supply Chain Management

Microsoft leans on its core advantage: familiarity. If your teams live in Outlook, Teams, and Power BI, Dynamics 365 feels like an old friend that now plans inventory, schedules production, and books freight.

Because everything runs in Azure, you avoid hardware chores. Data moves through a common model shared by Finance, Sales, and Field Service, giving you one product master and one truth. A salesperson’s large order updates demand forecasts in seconds, planners receive an alert, and Power Automate issues supplier POs without code.

Recent updates add an AI copilot that surfaces supply-risk insights in plain English and an Inventory Visibility service that tracks stock across millions of transactions each minute. Implementation partners report midsize manufacturers going live in six to nine months, quick by ERP standards.

Depth still matters. Power users needing ultra-granular optimization sometimes pair Dynamics with a specialist planner like Kinaxis. For companies seeking quick wins and tight Office 365 integration, Dynamics 365 offers a balanced mix of capability, usability, and value.

How the four stack up at a glance

After four profiles, you might want a quick view.

SAP and Oracle feel like full-service resorts: they cover everything from boardroom strategy to forklift moves. Microsoft is a familiar business-class hotel, easy to check in and tightly tied to Office tools.

Blue Yonder and Manhattan focus on operations. One keeps product reaching the shelf; the other keeps boxes racing through the warehouse. Kinaxis and o9 target rapid planning and foresight, leaving daily execution to your ERP.

Match these personalities to your biggest bottleneck and the shortlist picks itself. Need a single owner? Choose a suite. Need precision in one area? Pair a specialist with the systems you already trust.

Keep the comparison matrix close when vendor slides start flying; the trade-offs will stand out in a minute.

Honorable mentions worth a peek

Infor Nexus excels at multi-enterprise visibility. When headaches start overseas, such as late containers or opaque supplier lead times, its global network traces every handoff and gives partners a single timeline.

E2open offers similar reach with broader scope. It stitches together trade compliance, logistics booking, and channel inventory, so a brand can launch a promotion and see at once whether upstream capacity will keep pace.

Coupa Supply Chain Design (born from LLamasoft) specializes in long-range network planning. Teams can test new DC locations, transportation modes, or carbon goals before spending a dollar on concrete.

Each tool works best when paired with one of the core platforms above. If your transformation depends on their niche strength, add them to the shortlist early.

The road ahead: smarter, greener, more connected

Artificial intelligence is moving from analyst to decision maker. Generative copilots already answer planners in plain language; next they will suggest full resolutions (reroute, reprice, replan) and carry them out once you approve.

Second trend: networks replace silos. Control towers will knit together facilities, suppliers, carriers, and even customers in one live feed. Delays will surface at chat speed, giving you hours, sometimes days, to pivot.

Third, carbon shifts from side metric to core KPI. Regulations tighten, customers vote with wallets, and investors watch ESG scorecards. Modern platforms calculate emissions in every scenario, so a lower-carbon option appears alongside the lowest-cost one. Future leaders will balance both automatically.

Choose a platform that embraces these shifts and your supply chain will stay ready for what comes next.

Article received via email