Smart financial planning helps organizations achieve sustainable success. When a company’s financial practices align with its core objectives, it optimizes resources, reduces risks, and drives long-term profitability.

Defining Strategic Financial Management

Strategic financial management involves planning, directing, and controlling financial resources to achieve strategic objectives. Strategic finance solutions and high-level objectives align seamlessly here, which means all monetary allocations directly advance the organization’s core purpose. Businesses can see trouble coming, and they then adjust quickly.

The Importance of Financial Planning

Effective financial planning forms the backbone of strategic financial management. Companies must forecast future revenue, expenses, and capital needs accurately. They use what they have wisely, setting themselves up for any shifts. When you map out your money, you can set real goals and watch how well you’re doing.

Budgeting as a Key Component

Budgeting is an essential aspect of financial planning. It’s about drawing up a clear budget that shows all your earnings and expenses for a particular timeframe. With a budget, you see your money, spot financial problems, and then fix them quickly. Every dollar counts in this system, helping prioritize critical projects.

Thinking Ahead

Spotting money troubles early and handling them well keeps things steady. Good money managers scan the horizon for storms and build their shelters before the bad weather arrives. You might divide your money into different places, get good insurance, or make a savings cushion. Businesses that spot trouble ahead protect their finances and keep growing strong.

Investment Decisions

Investment choices significantly impact an organization’s financial future. You’ve got to pick investments that earn well. And they better fit your company’s big picture plans. Companies always check market trends, what gives them an edge, and where they see themselves growing. Smart choices about where you put your money can boost your earnings and help things grow steadily.

Capital Structure Optimization

The structure of a company’s capital affects its financial performance. Smart money moves mean finding the best mix of loans and personal funds to cut costs and boost income. A company’s best funding plan finds a sweet spot between risk and reward. This lets them pay their debts and still put money into new growth.

Cash Flow Management

Efficient cash flow management is crucial for operational success. For a company to stay afloat and take off, it needs constant cash coming in. That’s how it pays the everyday bills and also puts money aside for big future projects. When you manage money strategically, you track every dollar in and out. You also make working cash work hard and keep enough funds available. Good money handling keeps you steady. It also lets you make smart future moves.

Performance Evaluation

Regular performance evaluation is necessary to assess financial strategies. It means reviewing reports – balance sheets, income statements – alongside metrics like customer acquisition costs or market share, all to gauge progress on major objectives. Reviewing work helps companies spot problems. Then they can adjust their plan.

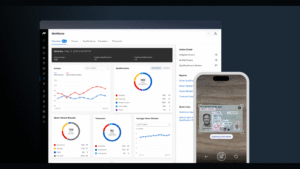

Role of Technology in Financial Management

Technology has transformed financial management. Imagine your business running smoothly, tasks handling themselves, and fewer mistakes popping up. Powerful software gives you that – plus it helps you understand the information you gather. With modern tools, businesses work faster, choose better paths, and adapt as markets shift.

Crafting Your Money Roadmap

You can build a strong financial strategy. Decide your goals, check current cash, and find places for it to grow. Organizations must regularly rethink direction. That way, their financial picture fits where the business is headed. To achieve long-term success, a financial plan must shift and adapt.

Global Connection

Getting more connected globally offers big wins but also brings new headaches. Companies abroad must adjust financial plans, understand currency shifts, and obey rules. Businesses that handle money smartly can succeed worldwide, grabbing chances and avoiding problems.

Conclusion

Want your business to win? Manage money smartly. Companies that blend financial blueprints with overarching strategies are better positioned to meet objectives and outperform rivals. To tackle what’s next, smart money handling calls for planning, watching risks, and checking performance. Businesses that plan carefully can succeed in our fast-moving world

Article received via email