Building trust has become one of the most valuable business assets in the global economy, and nowhere is this more evident than in how organizations manage financial crime risk. As illicit transactions grow more sophisticated each year, companies are under increasing pressure to strengthen compliance and enhance oversight across all markets in which they operate. This shift has pushed modern leaders to view anti-money laundering not just as a regulatory requirement but as a strategic differentiator. With the right AML tools embedded into their operations, businesses are discovering that compliance can create long-term value, strengthen investor confidence, and protect the brand in ways that traditional safeguards cannot.

A New Corporate Landscape Driven by Risk Awareness

Global enterprises today operate in a complex environment shaped by fast-moving regulatory expectations, digital transformation, and rapidly evolving financial crime threats. Regulators across major markets are introducing more stringent rules, extending oversight into digital channels, and placing higher accountability on corporate leadership. This has created a landscape in which companies must proactively manage risk rather than simply react to enforcement actions or compliance failures. The organizations that embrace this modernization mindset are the ones best positioned to lead.

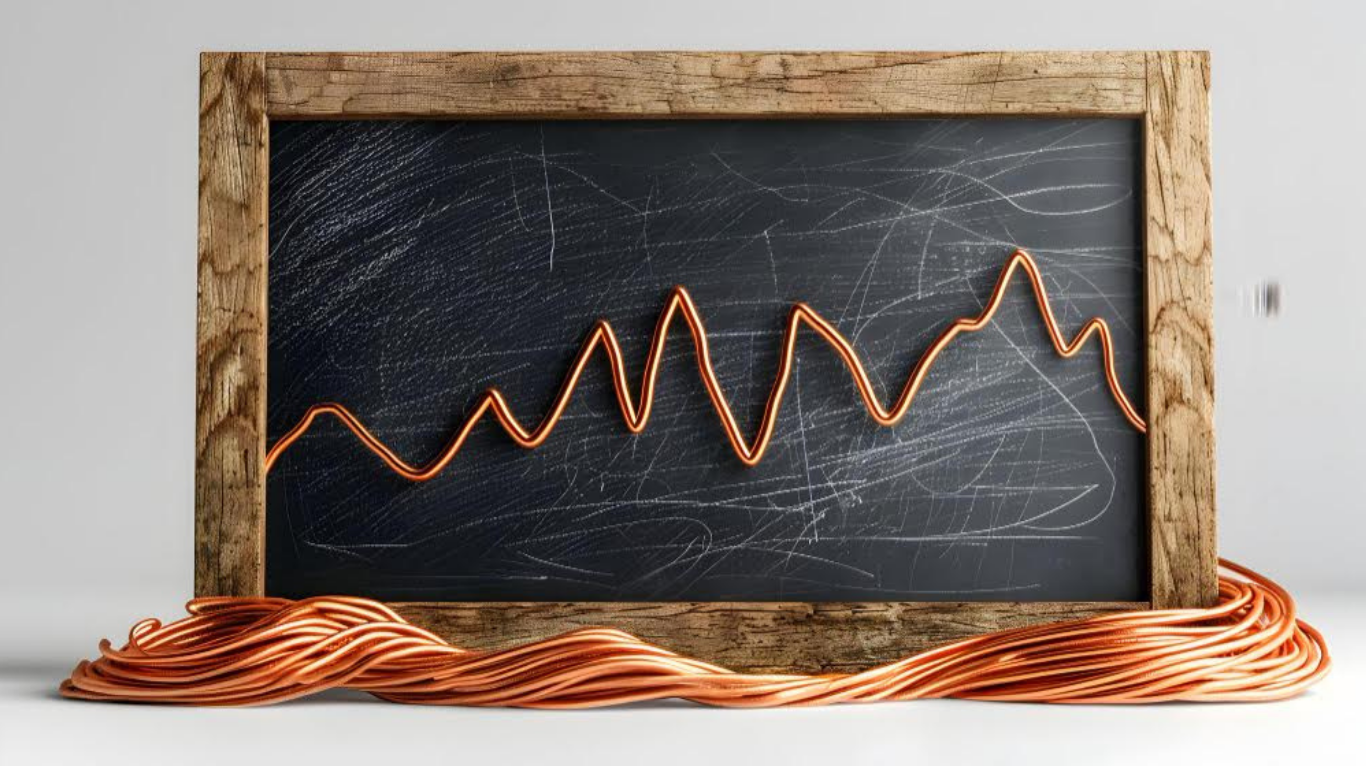

The rise of real-time payments, embedded finance, and cross-border digital transactions has created new vulnerabilities that traditional monitoring processes cannot keep up with. As fraudsters adopt advanced technologies, enterprises that rely on outdated systems expose themselves to significant operational and financial risks. A strong AML framework serves as a protective layer, helping businesses navigate this volatility with confidence. By investing in forward-thinking compliance strategies, companies position themselves as stable, responsible, and trustworthy partners to customers and investors.

A strengthened AML foundation also plays a decisive role in reinforcing internal governance. When organizations adopt comprehensive controls, they gain better visibility over internal processes, risk exposure, and the overall health of their financial operations. This enhanced transparency supports better decision-making and establishes a culture of accountability that resonates across all levels of the business.

AML as a Strategic Business Enabler

Many global enterprises used to view AML as an unavoidable cost center with limited impact on long-term growth. However, this perspective has shifted dramatically as business leaders recognize how a strong compliance posture creates measurable competitive advantages. Organizations with modern AML frameworks reduce the risk of penalties, avoid reputational damage, and retain the trust of stakeholders who now prioritize transparency and ethical conduct more than ever before.

Strong AML systems can also streamline operations by reducing inefficiencies associated with manual monitoring and fragmented reporting. Modern platforms use automation to identify suspicious activity, categorize alerts, and provide meaningful insights that help compliance teams prioritize high-risk cases. This improves response accuracy and frees teams to focus on high-value investigative work. The result is a more agile organization that can handle growing transaction volumes without sacrificing oversight.

Beyond risk reduction and efficiency, advanced AML capabilities support global expansion. When a business enters a new region, regulators, financial institutions, and industry partners need assurance that it can manage risk at an international scale. Companies with robust AML frameworks in place are more likely to be approved for licensing, secure stronger banking relationships, and win competitive bids with large enterprise clients. This makes compliance a driver of strategic growth rather than a barrier to entry.

Increasing Stakeholder Expectations Around Compliance

The business world is paying closer attention to how companies safeguard their financial ecosystems. Investors, shareholders, and customers now evaluate organizations based not only on performance but also on integrity and risk management. Financial crime incidents can lead to long-term reputational damage, which impacts valuations, partnerships, and public perception. Enterprises with mature AML programs demonstrate discipline, transparency, and operational maturity that resonates strongly with these audiences.

Stakeholders also expect companies to respond swiftly to emerging threats, especially as geopolitical tensions, cybercrime, and new forms of digital fraud escalate. A resilient AML framework enables a rapid response to these changes by offering real-time monitoring, adaptive risk scoring, and the ability to adjust thresholds and workflows as threats evolve. This flexibility allows organizations to stay ahead of risks rather than falling behind them.

Internally, a strong AML environment reinforces the values that underpin ethical business practices. Employees gain greater awareness of compliance responsibilities, leadership teams gain confidence in protecting company assets, and the entire organization benefits from a culture rooted in accountability. These internal advantages translate directly into better performance and stronger stakeholder relationships.

Building a Sustainable Advantage Through AML Innovation

In the modern corporate world, innovation in risk management is no longer optional. Companies that integrate advanced technologies into their AML frameworks are building systems that continuously evolve, adapt, and improve. Artificial intelligence, machine learning, and advanced analytics are enabling organizations to detect anomalies faster and with greater accuracy. These tools reduce false positives, improve investigative workflows, and deliver insights that strengthen long-term strategy.

By committing to ongoing innovation, enterprises ensure that compliance becomes a source of resilience rather than a static requirement. This positions them as forward-thinking leaders who prioritize security and responsible growth. In industries where trust plays a decisive role in customer choice and corporate performance, leadership is a defining competitive advantage.

Conclusion

Strong AML frameworks are no longer just regulatory obligations; they are essential systems that shape how organizations compete, grow, and protect their reputation in the global marketplace. As financial crime threats become more complex and stakeholder expectations rise, enterprises that invest in modern AML strategies strengthen their operational foundation and gain a lasting edge over less prepared competitors. By prioritizing compliance and leveraging innovative technologies, global businesses can build trust, reduce risk, and secure a position of stability in an increasingly unpredictable world.

Article received via email