Due diligence is like the backbone of any business deal, like M&As and IPOs. Effective due diligence is among the key success indicators in such transactions. Due diligence helps businesses assess the risks and rewards attached to buying a business or investing in a company.

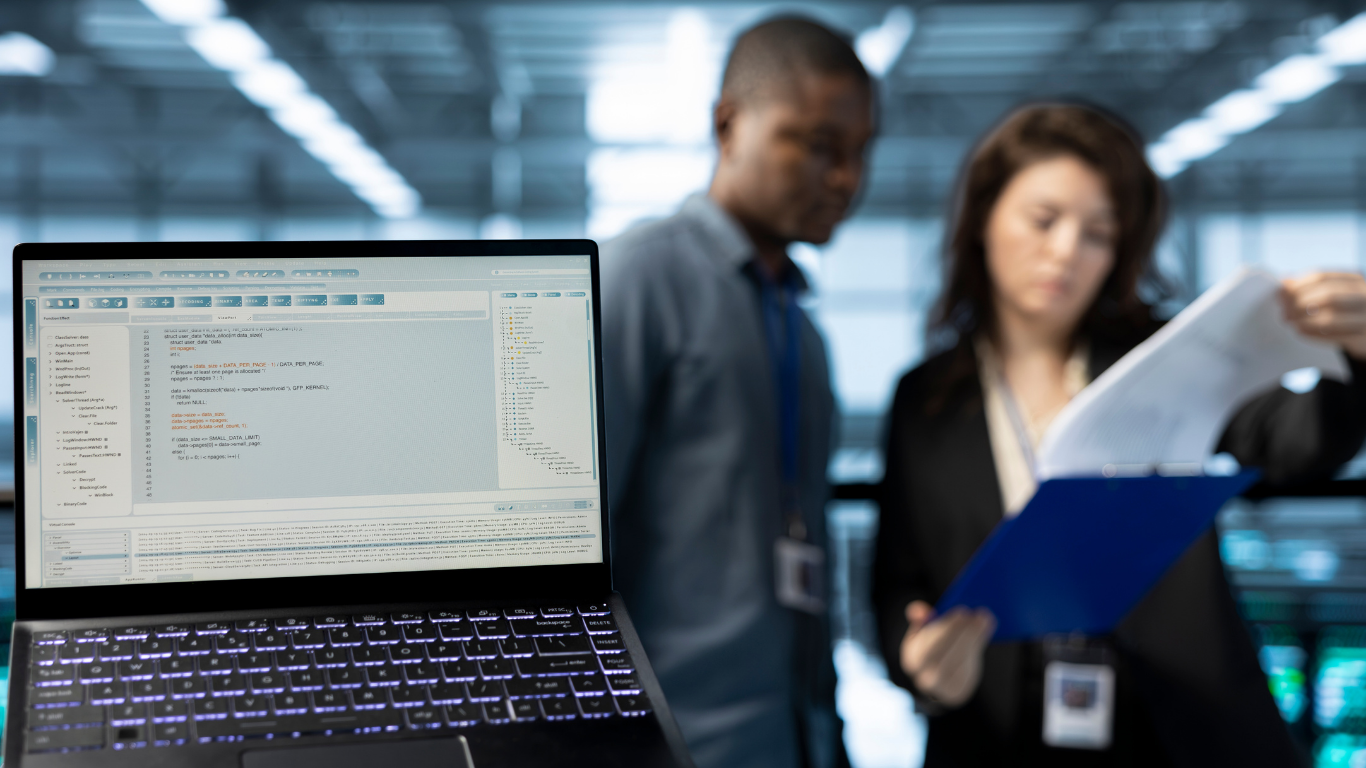

As due diligence is a core ingredient of financial deals, it is highly important to do it right. There should be seamless collaboration and easy data access for the concerned parties. One proven and globally accepted way to conduct effective due diligence is to use virtual data room software.

Read on to learn more about the due diligence data room and why it is important for efficient business deals.

What is Virtual Dataroom Software?

Digital data room software is an internet-based repository for storing and managing documents, files, images, patents, software, video, and other intangible assets.

Any professional, firm, company, government agency, organisation, or any professional from any industry can utilise the data room for various purposes.

The reason that online data room software is well-known in the corporate sector is not only due to its data storage capabilities. It is a complete business solution that contains data management, online communication, and project management functionalities.

How do Virtual Data Rooms Work?

Since data rooms are virtual platforms, you can utilise them as your off-site document storage solution. You can store all your documents in one location and organise them the way you desire. Users can access virtual data rooms through desktops, tablets, mobiles, or laptops. That implies that you do not require on-premises databases to operate your business. Here is what else a data room enables you to do.

· Add or remove other users within the data room according to your requirements.

· Read, edit, annotate, change, or modify your business or personal documents.

· Send data to other users within your data room.

· Schedule, plan, and organise online meetings with your business teams or the aforementioned parties.

· Use VDR chat messenger for business or personal communication instead of other insecure messaging apps.

Most importantly, you can do the above things from your smartphone. In short, digital data room software enables you to have your business information in your pocket.

Advantages of Virtual Data Room in the Due Diligence Process

“Due diligence simply makes or breaks M&A deals. You have to be at your very best to make sure the process is smooth and efficient, and data rooms for due diligence help you achieve that. These solutions are smart, secure, and provide you with everything you need to conduct smooth due diligence. The best part is that you get all that in one place,” says Ronald Hernandez, VDR Expert and Senior Business Analyst. You can also explore some of the best virtual data room providers at https://dataroom-providers.org/blog/best-due-diligence-software-solutions/

Here is how data rooms help businesses in due diligence.

1- Simple access to Due Diligence Documents

Seller or target companies upload due diligence documents in virtual data room software and then invite buyers. Acquiring companies do not need to send their due diligence team to the seller company’s location as they can access necessary documents at any time, from any location in the world.

2- Data Security

If the target company posts its documents on the internet, how would it ensure that sensitive information is not used or stolen? Online data room software ensures that the target companies maintain 100% control over their information in the VDR.

The seller company has the authority to determine who should or should not access certain data and for how long. Buyers may be restricted from copying, downloading, printing, editing, or scanning prohibited documents.

3- Real-time communication

Communication is a central aspect of the due diligence process. Buyers have the opportunity to interact with representatives of the target company through various channels. For instance, the data room contains HD video/audio conferencing facilities for meetings.

In addition to that, Q&A modules are the best means of communication during M&AS since they enable buyers to pose questions and receive responses in real-time. One-on-one communication also exists through the data room messenger.

4- Faster M&A Deals

VDRs give you the luxury of negotiating or dealing with several potential buyers at the same time. Simply upload all due diligence documents from your master account, set up individual data rooms for the buyers, share documents, and close the deal with the best offer.

However, it is important to invest time and money in a high-quality due diligence virtual data room for safe and efficient proceedings at all costs. Here are some important things to consider.

· The data room provider must be ISO 27001 compliant.

· Make sure the data room has security features like MFA, granular access permissions, and fence view mode.

· Thoroughly go through the data room price structure. The flat-monthly model is more suitable for large-sized transactions.

· Read virtual data room reviews from credible sources to assess the vendor’s reputation.

· Ask the service provider for a free demo or trial.

Final Words

Virtual data rooms were initially used in M&A (due diligence), and it’s the largest application of this technology to date. That is because data rooms simplify due diligence more securely and efficiently. Some of the top data room providers for due diligence are Ideals, Intralinks, and Merrill.

Blog as received in the mail