How are digital payments and financial inclusion transforming the economic landscape of the Gulf countries? Konstantin Tserazov, a renowned economist and former Senior Vice President of Otkritie Bank, delves into the complex interplay of digital payments and financial inclusion in this region. His focus is on how these technological advancements are reshaping the region’s economic landscape, particularly for marginalized groups like migrants and the unbanked. Tserazov critically evaluates the rise of fintech solutions as a means to bridge economic divides, and he also explores the emerging influence of Central Bank Digital Currencies (CBDCs) in these nations. His overview not only sheds light on the current state of financial technology in the Gulf countries but also offers foresight into the potential long-term impacts on their financial systems.

Financial inclusion is a critical topic in global discussions, particularly in Gulf countries. The rise in digital payments is reshaping access to financial services, fueled by the proliferation of smartphones, internet penetration, and fintech solutions. Despite these advancements, a significant number of adults worldwide, around 1.7 billion, still lack access to traditional banking but are increasingly utilizing fintech offerings.

The critical nature of financial services in society demands efforts to understand and address the perspectives of those facing financial exclusion. Various forms of societal exclusion exist, with homelessness being a notable example. In Gulf countries, rapid urban growth has led to a housing crunch, especially for low-skilled workers. For instance, Saudi Arabia has around 150,000 homeless individuals, followed by Qatar (10,000), Oman (4,000), and the UAE (2,500).

Addressing homelessness involves more than providing shelter; it encompasses giving individuals access to financial services. The lack of a permanent address often hinders the homeless from accessing banking services, underlining the need for alternative solutions like digital payments.

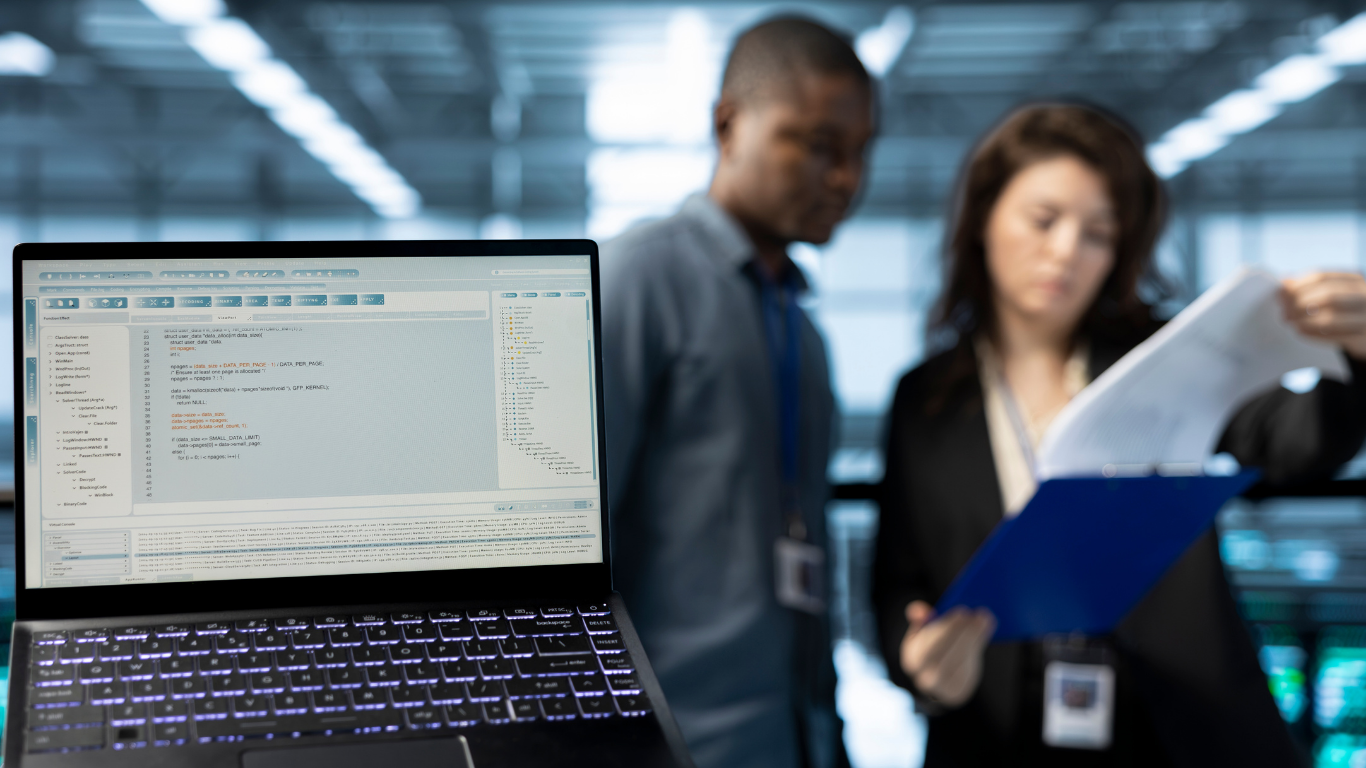

Digital inclusion is intertwined with financial inclusion, and motivation plays a critical role in technology adoption. Various motivations drive digital technology use, from instrumental (task-oriented) to social (connectivity) and hedonic (entertainment). Digital skills and usage evaluation consider how different groups use technology and the impact of their professional and demographic backgrounds.

Financial Inclusion of Migrants

In Gulf countries, the financial inclusion of migrants is significant. A large percentage of the population in these countries comprises expatriates, yet many lack access to banking services. This gap has fueled the demand for fintech solutions and digital payments, leading to substantial outward remittances.

Digital Disparity: A Barrier to Inclusion

The rise of information and communication technologies fosters financial inclusion but also highlights the digital divide. Addressing this divide is essential in developing financial services integrated with social media platforms, ensuring they are intuitive and accessible. The affordability of personal smart devices is crucial to bridge the digital gap.

The Role of Cash

While moving towards a cashless society, it’s important to consider the ramifications of excluding cash. In Gulf countries, a significant portion of transactions is still cash-based, serving as a necessary backup in emergencies.

Central Bank Digital Currency (CBDC)

CBDCs are becoming a focus in the Gulf region, with each country progressing at varying speeds. The UAE, for instance, is advancing with a digital dirham strategy. This strategy aims to improve domestic and cross-border payments and enhance financial inclusion.

Creating Digital Inclusion for All

Digital inclusion is fundamental to achieving financial inclusion. This involves ensuring everyone has access to and can effectively use digital technology. In Gulf countries, where banks are highly digitized, navigating the digital landscape is crucial for accessing banking services. Government initiatives like Oman’s eOman strategy and MpClear system are examples of promoting digital payments.

Conclusion

In summary, the Gulf countries are at a transformative stage regarding financial inclusion. Advancements in digital payments, coupled with the increasing adoption of digital currencies and blockchain technology, are democratizing finance and making it more accessible. Addressing both the digital and financial inclusion of all segments of society, including migrants and the underprivileged, is crucial for comprehensive economic growth and development.

Blog received on mail