The public release of the Bitcoin software followed in early 2009, and the genesis block of its blockchain was mined on January 3, 2009.

The birth of Bitcoin: how it all started

Digital gold’s anabasis all kicked off in 2008 during a global financial crisis. The mysterious Satoshi Nakamoto published a nine-page document on electronic cash architecture that posed an outright question: how can two people exchange value online directly, without relying on banks or trusted middlemen?

Satoshi’s answer (and the history of Bitcoin) hinged on three pieces: cryptographic proof, a distributed peer-to-peer network, and a public ledger of all transactions (the blockchain). The white paper argued that a trustless system could fix “double-spending” – a key flaw of digital currency attempts until then.

Shortly after laying out the theory, a live system followed. The first block – the genesis block – went live in early 2009. It carried an embedded message referencing lax bank policy. Satoshi’s critique of financial institutions received an embodiment. Early miners began creating coins. Yet not for profit, they did it to test the system.

Early years of experimentation (2009–2013)

In the quiet weeks after the genesis block, Bitcoin lay in wait – only a few miners fed hash power into its network. The first user transaction occurred in January 2009 when Hal Finney received 10 BTC from Satoshi. At that time, the coin held no market value.

The question of when did Bitcoin come out then got a quirky milestone: on May 22, 2010, Laszlo Hanyecz traded 10,000 BTC for two pizzas. That deal, worth about $41, became a symbol of Bitcoin’s leap from digital experiment to real-world value utility coin. Except it skyrocketed to the heights and left pizzaboy wondering why he had not kept those coins for himself.

By 2011, BTC touched parity with the US dollar and then climbed further. That rally brought wider exchange setups and speculators into the mix. Platforms like Mt Gox emerged and Bitcoin volume grew.

Crashes, growth, and mainstream attention (2014–2020)

In 2014, the Mt. Gox exchange collapsed spectacularly, halting withdrawals and filing for bankruptcy after admitting to the loss of roughly 850,000 BTC. At its peak, the platform processed over 70% of global Bitcoin trades, so its failure sent shock waves through the crypto world.

As the fallout settled, the sector shifted gear. The rise of the Ethereum network in 2015 enabled new kinds of token projects, and by 2017 the ICO boom exploded. Projects raised more than $10 billion in that year via token sales, sometimes with little regulatory oversight. Headlines carried stories of overnight gains, but also of exit scams and failed tokens, which triggered regulators to start paying attention.

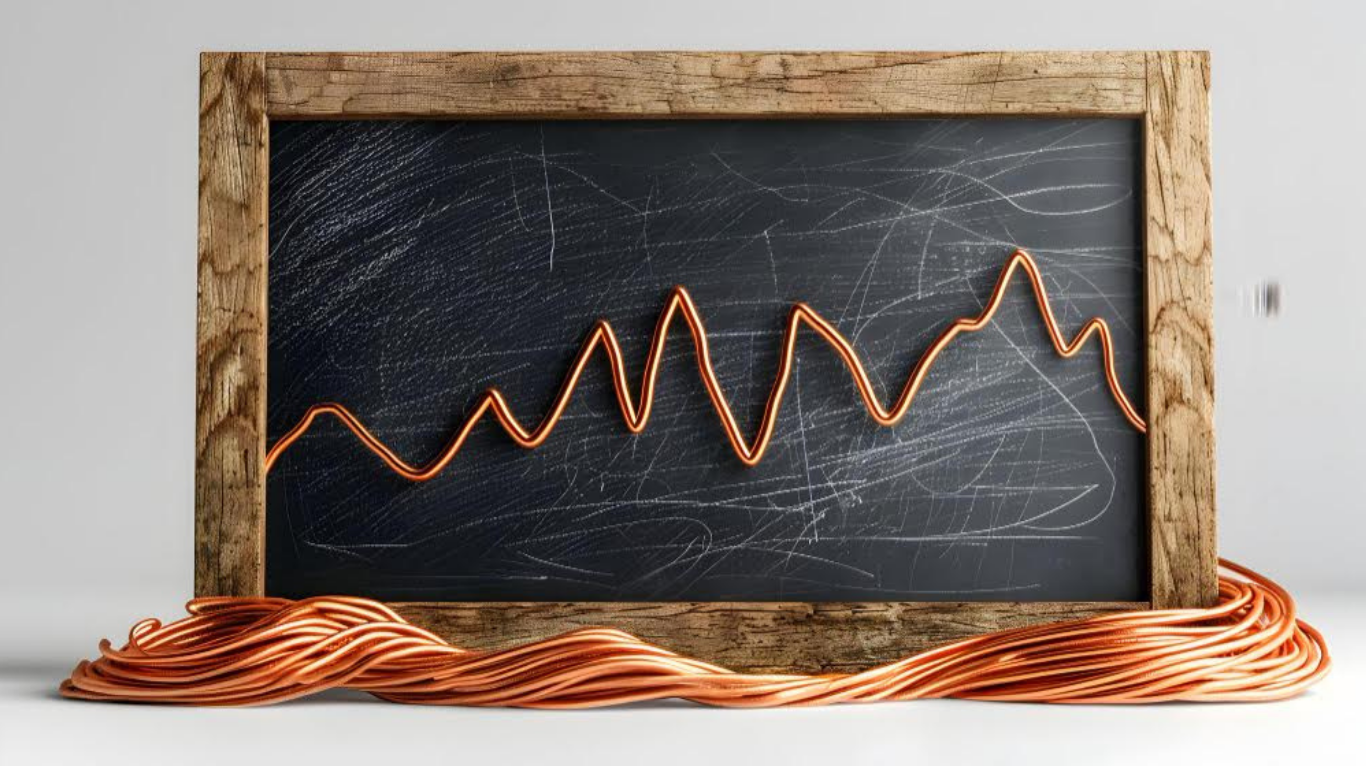

From 2017 to 2020 the value of Bitcoin surged and then corrected. BTC moved from under $1,000 early in 2017 to nearly $20,000 by December of that year. Volatility soared. But the story wasn’t just about price: it was about visibility. Bitcoin news coverage went mainstream. Institutional investors, asset managers, and even central banks began asking serious questions about blockchain and digital assets.

Bitcoin today and its future path (2021–present)

Since 2021, Bitcoin has transformed from a niche experiment to an institutional asset. Major global banks, pension funds and tech firms now hold BTC on their balance sheets. TradFi companies held about 6.2% of all outstanding Bitcoin as of 2025 – around 1.3 million BTC.

In parallel, the market for Bitcoin exchange-traded funds (ETFs) exploded. Spot Bitcoin ETFs in the U.S. surpassed $120 billion in assets under management by mid-2025. Regulation also adapted: on September 18, 2025, the U.S. Securities and Exchange Commission (SEC) approved generic listing rules, reducing ETF approval time from 240 to around 75 days. When was Bitcoin invented? For everyday users, it is not the main topic of interest right now, compared to the coin’s profitability.

Bitcoin now behaves more like a mainstream trading asset – it shows higher correlation with equities and macro-trends than before. Its correlation with the S&P 500 approached 0.87 in 2024. On the tech side, Bitcoin’s future depends on scalability and integration with DeFi, Layer 2s and real-world payments. And infrastructure is poised to improve.

Article received via email