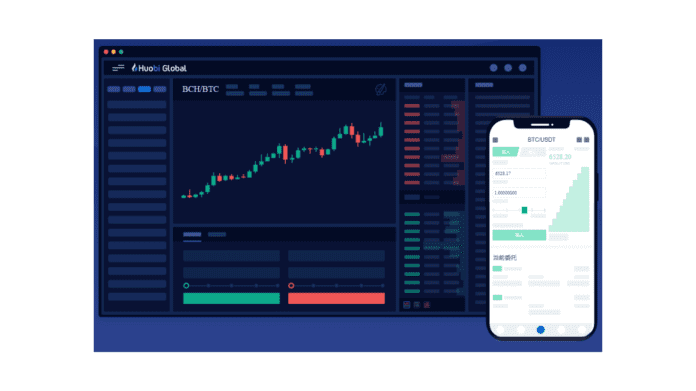

Huobi Global, one of the world’s leading digital asset exchanges, recently announced the launch of a trading fee rebate campaign for USDT-margined futures. As per reports, this makes it the first cryptocurrency exchange to offer maker fee rebates (as high as 0.015%) for all users. The platform also claims to offer amongst the lowest taker fees in the market: even normal users can receive 0.02% taker fees for trading USDT-margined futures.

Commonplace amongst digital asset trading platforms, the maker and taker model is a method to separate orders that provide liquidity (maker orders) and those that take liquidity (taker orders). In contrast to a taker order, which gets the fee when the order is matched instantly against an order already on the order book, a maker order gets the fee when the order is placed to the order book and is waiting for others to match with it. This particular campaign is unique in that it incentivizes all individual users who trade as a maker by offering them an additional 0.015% of their USDT-margined futures’ trading volumes.

USDT-margined futures play a vital role as derivatives by enabling investors to hedge a position, speculate on an underlying asset, or leverage their positions. With stablecoin USDT as the margin asset, users can trade multiple contracts without needing to purchase various assets. When people trade USDT-margined futures, the profits are calculated in USDT, making it easier for investors to benchmark and calculate profits. In addition to the high maker fee rebate, Huobi’s USDT-margined futures also offer fees as low as 0.02% for all users who trade as a taker. Typically, only the highest level of VIP or market makers can enjoy this benefit on competing platforms.

“We hope that even users with limited capital can benefit from our ecosystem, and this is why we’re launching this campaign. In addition to helping users save on trading costs, we also have sophisticated risk control systems that help assess risk and protect them from unexpected liquidation when they take leveraged positions,” said Jeff Mei, Director of Global Strategy.